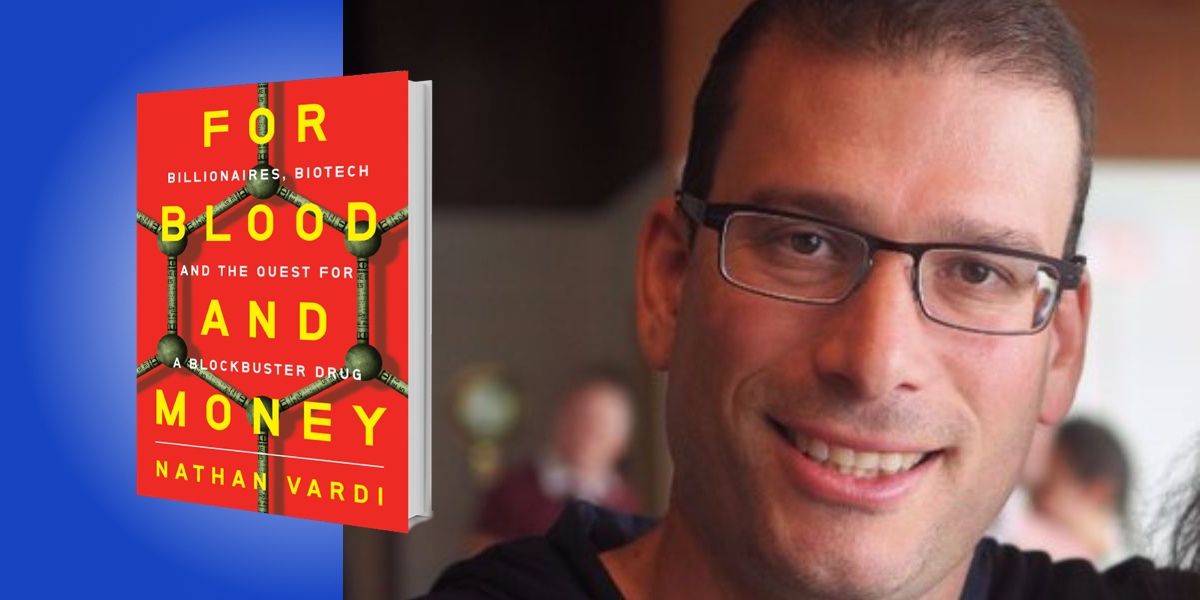

Nathan Vardi is a managing editor at MarketWatch and former senior editor at Forbes.

Below, Nathan shares 5 key insights from his new book, For Blood and Money: Billionaires, Biotech, and the Quest for a Blockbuster Drug. Listen to the audio version—read by Nathan himself—in the Next Big Idea App.

1. People who have experienced cancer can fight back.

Imbruvica was developed by a small company called Pharmacyclics. Pharmacyclics was co-founded by Jonathan Sessler and his cancer doctor, Richard Miller, who had treated Sessler for lymphoma when both were at Stanford. Miller treated Sessler with brutal chemotherapy. It was so bad that Sessler would reflexively throw up before his chemo appointments. But the treatment worked and Sessler became a chemistry professor. His cancer experience left an indelible mark and motivated him to apply his knowledge of chemistry to cancer therapies.

Sessler continued to see Miller for follow-up appointments and during his visits would update Miller on his latest work. At one appointment, Sessler described his synthesizing of new molecules that could potentially make tumor cells more sensitive to radiation. He thought they could be designed to accumulate selectively in cancer cells. Miller was intrigued and they started Pharmacyclics together to try it out.

Sessler’s approach didn’t pan out. Instead, Miller acquired a drug that Pharmacyclics would develop into Imbruvica, a novel cancer therapy. Pharmacyclics would end up developing Imbruvica while being run by Bob Duggan, a man who had no experience in drug development. He was partly motivated by the tragic death of his son from cancer at the age of 26.

2. Forgotten drugs.

Many great drugs are trapped in the pipelines of pharmaceutical companies, waiting for someone to discover them like buried treasure. Even after years of innovation, good drugs languish in the bellies of big conglomerates, bureaucracies too burdened with their own processes and procedures to identify and develop these tiny gems. These drugs can be fished out for pennies on the dollar and developed to help patients.

Imbruvica was created at a company called Celera Genomics, which shut down its development and didn’t even bother to patent the drug. As CEO of Pharmacyclics, Richard Miller negotiated to buy it in a deal that was centered around another drug. In total, Pharmacyclics bought three drugs for $6.6 million. The way the drug developers at Celera saw it, Imbruvica was essentially included in the deal for next to nothing.

“These drugs can be fished out for pennies on the dollar and developed to help patients.”

Calquence was created in the Netherlands at a company called Organon. Organon was sold to Schering-Plough, which was then sold to U.S. drug giant Merck. Merk was not interested in Calquence or its new Netherlands operation. It halted the drug’s developments and fired the scientists working on it. The drug was bought by a start-up called Acerta for an upfront cash payment of $1,000.

3. Like it or not, we need billionaires.

In the last decade, a big shift has taken place in the life sciences. Much of the innovation in cancer drug research has been coming out of small biotechnology companies, as opposed to big pharmaceuticals, which prefer the less risky approach of buying small companies that demonstrate success. These smaller companies are often controlled by their founders, some of whom are entrepreneurs, while others are often successful hedge fund managers or venture capitalists. These tend to be people with serious means—in other words, the super-wealthy.

When Bob Duggan, who was a successful businessman, became CEO at Pharmacyclics, it was headed for bankruptcy. The company’s stock traded for as little as 57 cents. He tried to sell a piece of Imbruvica, but no person or company was interested in financing its development. Duggan extended $6.4 million of personal loans to keep Pharmacyclics going and during those days authorized the start of Imbruvica’s first in-human trial.

“Much of the innovation in cancer drug research has been coming out of small biotechnology companies, as opposed to big pharmaceuticals.”

Calquence would have never been developed if it weren’t for Wayne Rothbaum, a billionaire stock trader who operated under the radar in New York. After Merck shut down its development, Rothbaum personally funded the development of Calquence, risking a big chunk of his net worth, and got some of his billionaire buddies to shoulder the rest of the investment required.

4. Unsung heroes.

Raquel Izumi was a senior director of clinical development at Pharmacyclics. She worked tirelessly to design and enroll the key later stage clinical trials for Imbruvica. Her work was noticed. Pharmacyclics’ CEO Bob Duggan called her into his office, gave her the biggest raise of her career, and called her a “linchpin” for the company. A month later, Duggan fired Izumi for reasons that he has never explained. Izumi felt like she had done the best work of her career, maybe the best work she would ever do, and been fired for it.

Not long afterwards, Izumi snuck into an important presentation of Imbruvica data at a big medical conference in Chicago. She was so proud of the drug she had worked on and so sad it would be moving on without her. Izumi sat in her auditorium seat and cried.

“Izumi felt like she had done the best work of her career, maybe the best work she would ever do, and been fired for it.”

Izumi persevered and co-founded Acerta, even though it might have made more sense for her to get a decent paying job. She had two kids and for a while was on unemployment insurance. But she was incredibly dedicated to finding treatments for patients who she knew needed help. At Acerta, Izumi wrote just about every clinical trial protocol for Calquence and helped get the cancer drug to patients.

5. Luck.

For all the tens of billions of dollars spent each year on cancer drug development, most cancer drug researchers are just stumbling around in the dark. Occasionally, a variety of factors— including luck—come together to produce a truly innovative winning treatment. It is a game of overwhelmingly negative odds. The vast majority of novel cancer drugs tested in patients fail.

Imbruvica was created at Celera Genomics as a tool compound for rheumatoid arthritis. It was a covalent drug, which irreversibly stuck to its protein target. At the time, pharmaceutical companies overwhelmingly shunned covalent compounds and Imbruvica was not meant to be a viable drug candidate. But Pharmacyclics acquired the drug and its CEO, Richard Miller, decided to give it a try in blood cancer, particularly lymphoma.

When Miller wrote the plan for the first in-human trial of Imbruvica, he included in the study patients with chronic lymphocytic leukemia (CLL). It was a bit unusual to include CLL patients in a lymphoma plan but Miller had a good reason. In CLL, many of the malignant cells are in the bloodstream, whereas with most lymphomas the cancer cells are largely in the lymph nodes and other tissue. Miller wanted to be able to measure and observe how the drug bonded to cancer cells. With CLL patients he could do this with a simple blood sample, as opposed to cumbersome biopsies, which would likely be required in lymphoma patients. Pharmacyclics went ahead and tested Imbruvica in humans with different lymphomas and CLL. It would end up making the biggest difference for CLL patients.

To listen to the audio version read by author Nathan Vardi, download the Next Big Idea App today: