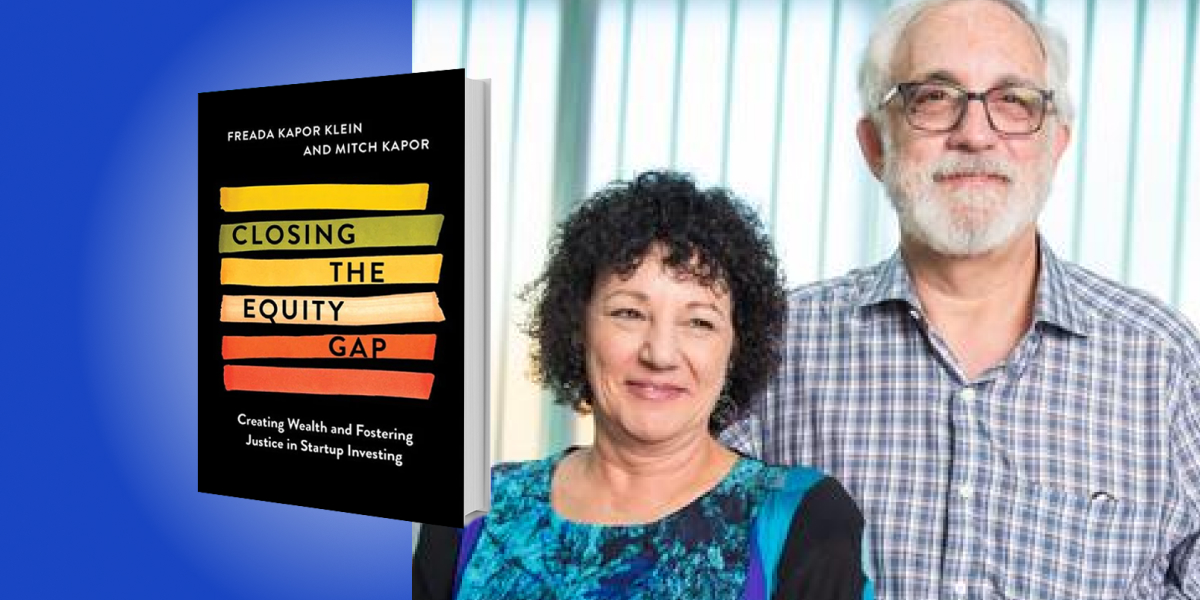

Freada Kapor Klein is an entrepreneur, activist, and a pioneer in the field of organizational culture and diversity. She is the founder of SMASH, the Summer Math and Science Honors Academy, and cofounded the Alliance Against Sexual Coercion, the first organization in the U.S. to address sexual harassment. She holds a PhD in social policy and research from the Heller School for Social Policy and Management at Brandeis University and is a member of the Obama Foundation Tech Policy Council, the UC Berkeley Board of Visitors, and a board observer of the air quality monitoring company Aclima.io.

Mitch Kapor is a tech entrepreneur and investor, co-founder of the Electronic Frontier Foundation and founding Chair of Mozilla, creator of the Firefox web browser. He founded Lotus Development Corporation and designed the Lotus 1-2-3 spreadsheet, cofounded the Electronic Frontier Foundation. He also serves on the board of SMASH.

Below, Freada and Mitch share 5 key insights from their new book, Closing the Equity Gap: Creating Wealth and Fostering Justice in Startup Investing. Listen to the audio version—read by Freada and Mitch—in the Next Big Idea App.

1. Value lived experience.

How do you spot an entrepreneur with a great backable idea? Often overlooked, a key indicator is one’s lived experience. Obstacles, barriers, and pain points are often more memorable and searing than high points and victories. How do we mine those awful experiences for great ideas that turn problems into solutions that make countless people’s lives much better?

In the Kapor Capital portfolio are many amazing entrepreneurs. One is Phaedra Ellis-Lamkins, co-founder and CEO of Promise Pay, helping ordinary families and low-income people pay their bills while being treated with dignity and respect. Behind on your utilities? No problem. Set your own payment amount, set your payment date, no fees, no interest. Everybody wins. The consumer helps their credit score and feels better about themselves—as it turns out, almost everyone wants to pay their bills. Cities, counties, and states get much-needed revenue for important services.

Where did Phaedra get this idea? The school cafeteria lunch line. As a child from a low-income family, she was eligible for free lunch, as are approximately half of the children in U.S. public schools. But Phaedra had to stand in a separate line from the kids who, only through accidents of birth, were born into a family that could provide lunch money.

Standing in that line was painful, humiliating, and motivating for Phaedra. Decades later it is still a powerful memory, enough to drive the core values and business model of Promise Pay.

2. Distance traveled is a better predictor for success than pedigrees.

Most high-profile businesses, whether in technology or on Wall Street, do their recruiting on elite college campuses. They believe that the best talent can be found there; after all, highly selective schools take only 1 or 2 percent of their applicants. But what they’re actually screening for is privilege i.e. unearned advantages. A former president of Princeton said that the best predictor of SAT scores was family income. So what’s a better, fairer way to find talent? We think it’s measuring distance traveled. Where one started out in life and how far they’ve ventured due to their own efforts tells us who knows how to overcome barriers and challenges, who has requisite grit and persistence, who can focus on a goal and achieve it despite the odds.

“A former president of Princeton said that the best predictor of SAT scores was family income.”

Our Kapor Capital entrepreneurs remind us daily of the value of focusing on distance traveled rather than pedigrees. Irma Olguin, Jr. is Co-founder and Co-CEO of Bitwise Industries, based in Fresno and now serving 10 previously underestimated cities by building vibrant tech ecosystems. As a fourth-generation member from a farmworker family, she rather accidentally found herself collecting bottles to turn in for 5 cents to save enough money to buy a Greyhound bus ticket from Fresno to Toledo to go to college. With an engineering degree and a world of opportunity now opened up for her, she returned to Fresno to create an alternative path for others just like her.

Irma recognized that it’s everyday life that gets in the way of most people pursuing education that will put them on a new career path, changing the future for themselves and their families. It’s the lack of child care or no reliable transportation or the needs of elderly or disabled family members that keep countless people from pursuing training. So Bitwise takes care of all of that. In six months, one can go from a minimum wage retail job through a paid apprenticeship program and on to a job that pays at least twice one’s previous earnings, and includes health care and a career ladder.

Increasingly focusing on skills-based hiring, Bitwise Industries is helping to fill hundreds of thousands of empty good jobs with talented people who were found through their distance traveled story, not their fancy degrees.

3. Loyalty to principles is sometimes more important than loyalty to a person or team.

The current landscape of layoffs in tech and other industries runs counter to the message by the same companies a year or two ago. Back then, we were all family, and creating a culture of belonging was paramount. Now, one hears CEOs saying businesses are not families and we have to manage to profitability.

So where does loyalty really fit in business? We think loyalty to a set of principles and values is the highest priority. It’s how our colleagues, managers, employees, and customers can reliably know what to expect.

“We think loyalty to a set of principles and values is the highest priority.”

We learned about an unwritten rule in the world of venture capital a few years ago. When we felt that Uber, under its previous leadership, wasn’t taking issues of its toxic culture seriously, we wrote a public letter holding it to account. The venture capital community—and others within the tech ecosystem—felt we had been disloyal to the CEO. We knew we had been loyal and consistent with our values and principles.

We were demonstrating to other founders and investors that we are good for our word when we say that we care about welcoming work environments. In fact, we have our Kapor Capital entrepreneurs sign a Founders’ Commitment as a condition of investment. That compels them to build a diverse team and an inclusive culture—not a check-the-box exercise, but a commitment to have their workforce look like their customers. So no two businesses will have the same goals, but each will have a competitive advantage against their peers who don’t have that commitment. After all, having employees who understand your customers is good business.

4. Impact investing is not concessionary.

The conventional wisdom on Wall Street. says if you take social impact into account in making investment decisions, your financial returns will suffer. Therefore social impact concerns are to be completely avoided.

Over a decade ago, Kapor Capital was founded as an experiment in challenging that conventional wisdom. Since 2011, we’ve been investing exclusively in tech startups whose impact comes from closing gaps of access, opportunity, or outcome in low-income communities and communities of color. When we invest, we not only ask whether the company has the potential to be a financial success, but we also ask which groups in society will benefit.

Our experiment yielded clear results. Kapor Capital’s returns, in a portfolio of over 100 companies, were in the top 25 percent of all venture funds of comparable size, regardless of their approach. That means we beat most firms by following the best advice, the conventional wisdom of seasoned money managers and investors. All the details are in impact reports published in 2019 and updated in 2022.

5. Take steps to know where your hard-earned money is invested.

Most of us have our savings in 401(k) plans with limited choices selected by our employers. Do we even know the underlying companies we’ve invested in? Would we be enthusiastic or embarrassed if we saw a list? Similarly, for those of us who went to college, sooner or later we decide to make an alumni donation. But do we know where they invest their endowment?

“Increasingly, there are ways for individuals to invest small dollars in startups.”

We think it’s time for more transparency and accountability by chief investment officers of endowments and by those who manage 401(k) funds. How do we ensure that we’re investing in line with our principles and values? What if we asked our employers to provide a much broader set of investment choices for our retirement funds?

Increasingly, there are ways for individuals to invest small dollars in startups. Crowdfunding rules are changing. One of our Kapor Capital companies, Career Karma, helps millions of people find the right bootcamp to fit their circumstances to learn coding, sales, or customer support. Career Karma then helps them find a peer group to make sure they persist. The CEO and co-founder, Ruben Harris, made sure that lots and lots of small investors could join his last big fundraising round.

What if every Chief Investment Officer of every major foundation and every major college or university was required to invest consistent with the institution’s mission? We’d have lots more funding available for startups founded by non-traditional entrepreneurs that are solving real problems.

To listen to the audio version read by co-authors Freada Kapor Klein and Mitch Kapor, download the Next Big Idea App today: