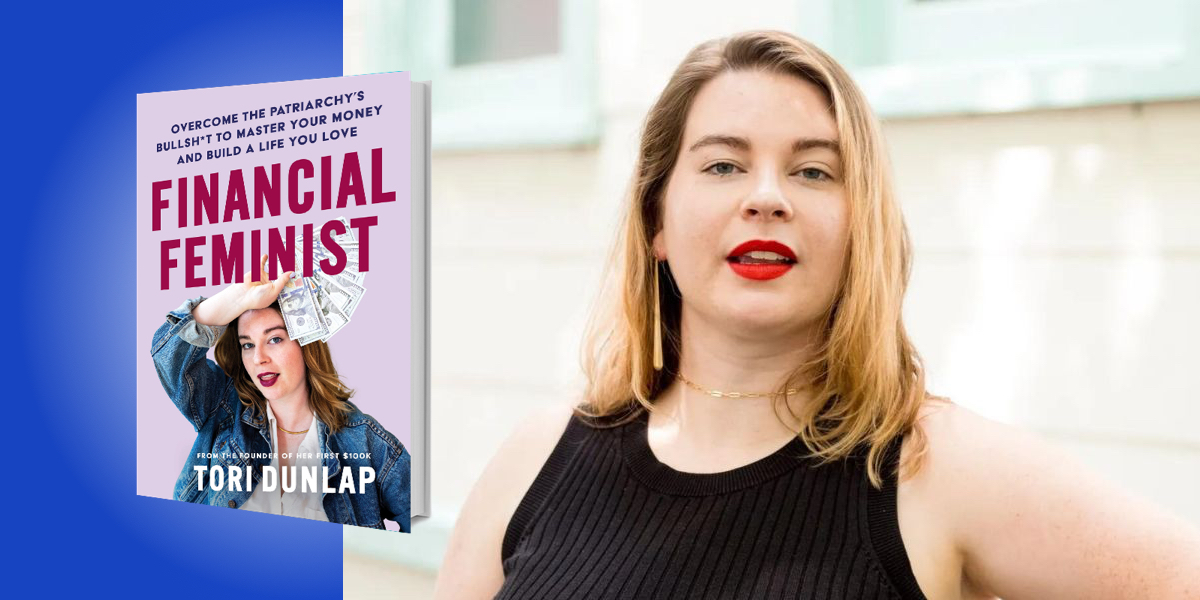

Tori Dunlap is an internationally recognized money and career expert, author, and podcast host. After saving $100,000 at age 25, Tori quit her corporate job in marketing and founded Her First $100K to fight financial inequality by giving women actionable resources to better their money. She has helped over three million women negotiate salary, pay off debt, build savings, and invest.

Host of the #1 Business Podcast on Spotify and Apple, Financial Feminist; Adweek’s “Finance Creator of the Year”; and co-creator of Treasury, an investing education platform that has over $25M invested, Tori’s unique take on financial advice has made her the go-to voice for ambitious millennial women.

Below, Tori shares 5 key insights from her new book, Financial Feminist: Overcome the Patriarchy’s Bullsh*t to Master Your Money and Build a Life You Love. Listen to the audio version—read by Tori herself—in the Next Big Idea App.

1. Myth: You should just know “how to money.”

I cannot tell you how often someone in our community says, “Sorry for the stupid question…” before asking an incredibly valid question about money. This idea that you’re always behind or that everyone else has some sort of secret knowledge you don’t is both unhelpful and unfair. You didn’t come out of the womb knowing how to tie your shoes, play the tuba, or speak fluent Italian. Yet we somehow expect ourselves to just know how to navigate a challenging and gatekept financial system.

The shame around not knowing “how to money” impacts every single financial decision we’ll make. We call it the ostrich effect, where you keep your head in the sand because it’s just easier not to know. But to overcome this, you have to be comfortable being uncomfortable.

This myth is one of the many ways the patriarchy keeps you from building wealth. While men are often brought up with the expectation of knowing money, they are also more likely to receive education from an early age about money. So learning about personal finance is a great way to start overcoming this shame, as well as the first step to building a stronger financial future.

2. Myth: Talking about money is impolite.

You’ve heard this one. We’ve all heard this one. We’re more likely to talk about sex, death, politics, religion, or literally any other uncomfortable topic before we’ll talk about money. This narrative is one of the most egregious because it often keeps us underpaid, overworked, and in the dark.

“By avoiding talking about money, all you’re doing is hurting yourself.”

We are told this narrative throughout our entire lives. But here’s the thing. Men are having conversations about money. They’re talking about stocks, bonuses, real estate, etc. By avoiding talking about money, all you’re doing is hurting yourself. You won’t understand you’re being underpaid because you won’t know what other people are making. And debt will make you feel siloed or alone because you won’t understand that it’s a common problem.

If this book gets you to do anything, let it be to talk about money. I want to teach you how to get comfortable talking about money with your friends, family, coworkers, and partner. Financial transparency is one of the fastest ways to grow your wealth and to start changing the equation for every single person.

3. Myth: You’ll be rich if you just work.

This is the ultimate shaming tactic. It completely ignores centuries of systemic oppression, structural racism, and discrimination. And yet, it is one of the most common narratives perpetuated in regular personal finance books.

More traditional finance experts have told you that the reason you’re not rich is because you don’t work hard enough. But a single mother working two jobs and raising a kid doesn’t need to be told to try harder or to make more money. She needs social structures and access to reliable childcare. I spend a good part of Financial Feminist going through how we can improve the things we can control, and then work to change the systemic issues at a societal level.

4. Myth: Wanting money is selfish unless you’re a man.

When I first shared about my journey of saving a hundred thousand dollars at age 25, I was shocked by how many people, especially on the internet, insisted that I was greedy, and asked invasive questions about if/how I was being charitable with my money, insinuating that I was a bad person for building wealth unless I was giving it all away. Then I’d flip to the next video of Elon Musk, where the same people criticizing me were now groveling at his feet over his accumulation of wealth.

“Women are expected to give and give and give.”

Typically, if a man posts a photo on Instagram of himself on the golf course, and he’s wearing a Rolex, the comments will be along the lines of “cool Rolex, bro, looks like you’re doing well for yourself.” But if a woman has the audacity to post a photo in a designer dress, we tell her that she’s a frivolous spender. We say that she’s selfish and that she should be donating her money. We condition women to be altruistic, and then we threaten that altruism as soon as women start building wealth, because that’s when they become uncontrollable. Women are expected to give and give and give.

As my business grew, I found myself feeling shame around my financial success. This narrative showed up in my conversations with friends as well. It’s especially insidious as it begs women to act small, to stay hidden instead of actively pursuing wealth and growth.

When you are avoiding pursuing wealth, you are controllable. Overcoming this false narrative is key to changing your money story.

5. Myth: “Money can’t buy you happiness.”

The idea that money can’t buy you happiness is bullshit. What money can buy you is healthcare. What money can buy you is food on the table. What money can buy you is stocks. Money is a tool. It buys you freedom, choices, and options.

“When you start gaining power, this false claim is meant to keep you playing financially small.”

Money affords you the freedom to leave toxic workplaces or abusive partners, or to live where you want or buy groceries or repair your car, to afford simple luxuries without guilt. Money can’t buy you happiness is what the patriarchy says when you show interest in becoming financially powerful. When you start gaining power, this false claim is meant to keep you playing financially small.

Financial Feminist is about playing big. It is about breaking through every glass ceiling, knocking down every gate, and then helping the people around you do the same. Shedding these myths is only part one, but it’s an important first step. It lays the foundation for how to overcome your financial trauma, how to spend mindfully without deprivation, how to budget without wanting to die, how to invest using stable, long-term, consistent strategies, how to pay off debt, how to negotiate your salary, and how to vote with your dollars.

More than that though, it’s about utilizing monetary tools to not only build a financial foundation, but to show up more confident in every aspect of your life, as well as to start changing the systems that are inequitable—how to make you great with money and change the world.

To listen to the audio version read by author Tori Dunlap, download the Next Big Idea App today: