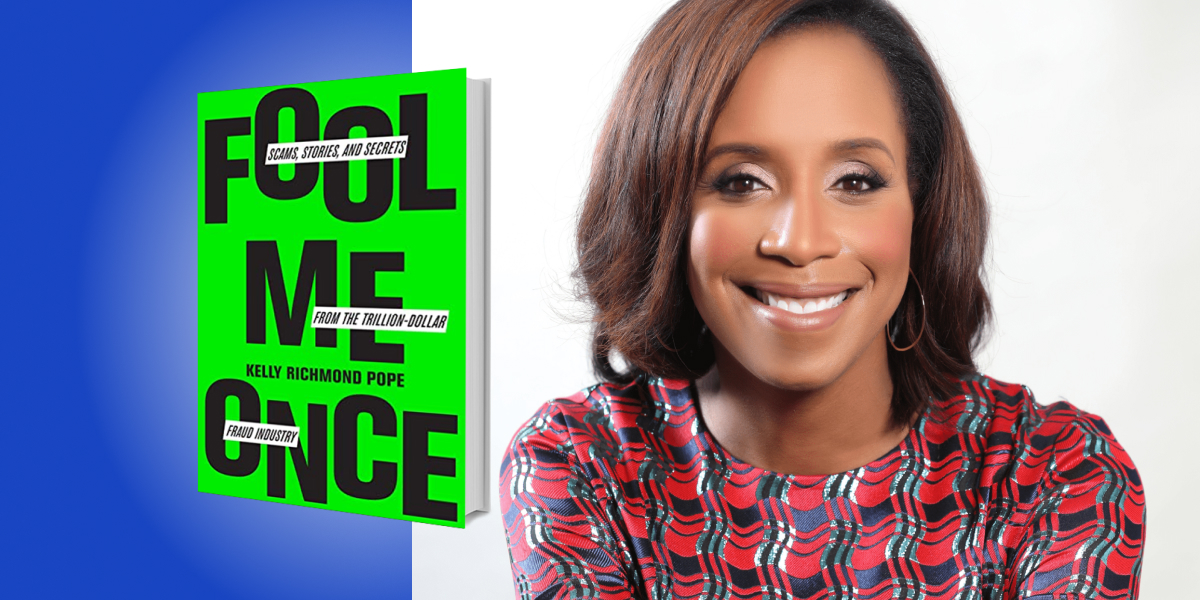

Kelly Richmond Pope is the Dr. Barry Jay Epstein Endowed Professor of Forensic Accounting at DePaul University in Chicago, IL. Pope is a nationally recognized expert in risk, forensic accounting, and white-collar crime research, and an award-winning educator, researcher, author, and award-winning documentary filmmaker. In 2020, the AICPA and the CPA Practice Advisor named Pope among the top 25 most powerful women in accounting.

Below, Kelly shares 5 key insights from her new book, Fool Me Once: Scams, Stories, and Secrets from the Trillion Dollar Fraud Industry. Listen to the audio version—read by Kelly herself—in the Next Big Idea App.

1. Under the right circumstances, any of us can commit fraud.

This may be a controversial statement, but it is very true. You may be saying to yourself that you would never steal anything, but let’s investigate this topic a little deeper. Do you know someone that plans a family member’s birthday or vacation during work hours? Or better yet, you may use the office copy machine to photocopy the invitations. Harmless right? But if everyone did it, this could get very expensive for the company. As minor as it seems, this is an example of expense fraud. In the U.S., expense fraud costs companies $1 billion per year. Really the only way we can stop it is to employ strong prevention and detection strategies to keep organizations safe. Too many of us can rationalize why it’s ok to make those copies, or claim some personal expenses as work expenses on our tax returns or overbill a client to make quarterly sales goals.

Another example of a person turned offender under the right circumstances is a woman by the name of Rita Crundwell. Rita Crundwell was the former city comptroller of a small midwestern town called Dixon, Illinois. I learned of Rita’s crimes during the direction and production of a documentary called All the Queen’s Horses, which chronicles how Crundwell embezzled $53.7 million dollars over a 20-year period from her hometown. Before delving into the fraud, let me tell you a little about Dixon so that you can put the fraud scheme into context. Dixon is located about three hours west of downtown Chicago. It has a population of around 16,000 people. It’s the quintessential small town. Tree-lined streets, quaint shops, everyone knows everyone, etc. It is a place where it’s perfectly fine to not lock your doors at night.

People trusted Rita. Why would you not? She was born and bred in Dixon. Little did the Dixon residents know, however, that Rita was stealing their tax dollars and using them for her lavish lifestyle. Rita was also one of the country’s number one quarter horse breeders, winning 52 world championships. As you can imagine, owning over 400 horses can get pretty expensive, but if you have access to money and there are few internal controls, it’s easy to be tempted to steal.

Donald Cressey, the renowned criminologist developed something called the fraud triangle. The three components of the fraud triangle are rationalization, opportunity, and pressure. This framework allows us to break down and understand fraud. In the case of Rita, her opportunity was that she had access to money (and many of us do). Her pressure was self-induced; she wanted to be one of the number one quarter horse breeders in the world. As you can suspect, horse breeding is a very expensive obsession. Her rationalization is the part that continues to intrigue about this case. Because Rita has never spoken publicly, we can infer her rationalization was that she was going to borrow the money and put it back later.

Well, later never came, resulting in her embezzling $53 million. Remember, fraud happens all the time and by anyone. If you really want to understand the profile of a white-collar felon, just look in the mirror. Remember, under the right circumstances, any one of us can commit fraud.

2. Always pay attention to red flags.

Have you ever observed how people behave when a fire alarm goes off? One afternoon while in my office, the building fire alarm went off. My office is located in downtown Chicago on the sixth floor, so the elevator is the main way up and down, except when the fire alarm goes off. Upon hearing that alarm, immediately, I gathered my things and started knocking on my colleagues’ doors, but no one budged. I knew they were in the office because I had just seen them moments before, so I knocked and moved on. Why? Because the fire alarm was going off! What I realized at that moment is the following: we are so conditioned to think that there is no fire and it’s only a false alarm, that we tend to do nothing. We carry on like business as usual. When in fact, we should be doing something and doing something quickly, like getting out of the building. This same behavior of not paying attention to red flags happens when fraud is occurring.

“Red flags were waving high yet no one did much about it.”

Red flags are all around us, and research suggests that we tend to ignore them. There were red flags in Dixon: a city employee owning over 400 horses, an employee taking four months off vacation time, very few internal controls around the person that controlled the finances, the same auditing firm for more than five years, very little town engagement. The list goes on and on. Red flags were waving high yet no one did much about it.

We’ve become so trusting that we never suspect that people that we know, our C-suite executives, could defraud our organizations. Take Bernard Madoff, for example. He was trusted, admired, and revered, and yet, he was running a sham the entire time. Even with Madoff, there were red flags. For example, a business of Madoff’s size would have had a much larger accounting firm handling its operations. At the time, it was frowned upon to even ask Madoff a question, so no one ever did. Madoff’s returns outperformed industry norms in an unexplainable way. These red flags were everywhere, but only a few paid attention. When the SEC finally began to listen to the lone whistleblower, unfortunately, it was too late.

3. All perpetrators are not created equal.

After doing interviews for over 15 years, I started to reflect on the emotional roller coaster I’ve been on while diving into these fraud cases. I asked myself, why are some of the offenders I’m angered by and where are the others with whom I can empathize? We know there’s nothing wrong with having empathy because it’s what makes us human, right?

It’s the clarity I needed around my own empathy that guided me in creating a new fraud archetype that builds on the groundbreaking work started by Donald Cressey. We talked about the components of the fraud triangle which are opportunity, pressure, and rationalization. Being curious about the rationalization component, I wanted to look at it from every angle; from the perspective of the perpetrator, the prey, and the whistleblower. Let’s focus on the perpetrator for the moment. It’s important to understand this vital point; everyone does not steal because of greed. At least, that’s not everyone’s initial intention. Understanding this initial intention is what will allow us to believe that all perpetrators are not created equal.

If you are like me, you are hooked to all things crime-related on TV. That can be any good crime series about what I refer to as an intentional perpetrator. This is a category of offenders that seeks to defraud. They’re not con artists, rather they are persuasive, narcissistic, risk-taking leaders that are likable and aggressive all at the same time. They often have an ‘ask for forgiveness, not permission’ type attitude. They believe in achieving results, but how they get there could be a tad shady. I’ve interviewed my fair share of intentional perpetrators and I’ve always left those meetings utterly confused. I’m often angered by their arrogance and overconfidence displayed in order to execute their scheme. But, the thing is, we all display some level of confidence, arrogance, and narcissism.

The next two categories, however, pull at the heartstrings just a little bit differently. These two categories are accidental perpetrators and righteous perpetrators. Let’s start with the accidental perp first. The accidental perp is the team player, the people pleaser; the one who follows the boss’s order (sometimes blindly). They’ve made an unethical decision that positively benefits the organization or people inside the organization, but rarely for direct personal financial gain.

“Everyone does not steal because of greed. At least, that’s not everyone’s initial intention.”

During interviews with an accidental perp, my empathy rises. I often think of my friends who work in senior leadership roles or attendees I’ve met in my training workshops who have been in the shoes of many of the accidental perps I’ve interviewed over the years. They are trying to help their organization. And that could be to help save jobs, help with improving the balance sheet for a potential acquisition or just keeping their boss happy. When they are sentenced, your heart goes out to them. Why? Because maybe we see ourselves in them.

Our last category is the righteous perpetrator. Similar to the accidental perpetrator, the righteous perp is not engaging in fraud for direct personal financial gain. Instead, they are using their organizations to help someone outside of their organization. That person could be a friend, a family member, or even society. Do you know another person that wanted to help people? Elizabeth Holmes, the former biotech entrepreneur and now convicted fraudster. We can all agree that she lied and she lied badly, but why?

Instead of having to take vials and vials of blood, wouldn’t life be easier for patients if all tests could be run on just a finger prick? Holmes wanted to do good, and, in her mind, she was doing good. She used her power and her privilege to create a sham, and in the end, it all came to a crash—but really, she was trying to help. Holmes started out as a true righteous perpetrator, but as time progressed, she entered into the intentional perpetrator category.

Remember, not all perps are created equal, and understanding their initial intentions could help you set up better internal controls to prevent future problems.

4. Think like a perp and you will never be prey.

If you’ve ever been victimized, whether as an individual or an organization, you already know the personal toll this takes. You spend hours wondering “why you” and “how did this happen.” In some cases, we make it easy to be targeted because we provide all of our personal information on social media. At the individual level, you could be an innocent bystander, not even aware that fraud is lurking around the corner.

When innocent bystanders, also referred to as individuals victimized by a perpetrator, reach out to me looking for help, it’s always hard. It’s hard because there’s a natural vulnerability embedded in life that we just can’t control. From the water we drink to the cars we drive to the medicines we take, we have to assume that things are what they say they are, and unfortunately, we can’t always verify if something is fraudulent. This is what makes life scary.

Think about why the elderly are so frequently targeted. They tend to have more savings; they can be more generous, and sometimes have less fiscal oversight from outside family members. Research from the FBI finds that cybercriminals stole $1.8 billion from unsuspecting older Americans in 2020. The most common scam? Tech support frauds! Tech support fraud happens when an intentional perpetrator poses as a technician who will resolve an issue such as a compromised bank account or a computer virus and will interact with the innocent bystander gathering valuable personal information that allows them to engage in identity theft.

“Research from the FBI finds that cybercriminals stole $1.8 billion from unsuspecting older Americans in 2020.”

Intentional perpetrators can also victimize companies, referred to as organizational targets. The U.S. government, though not a company but a large organization, became an organizational target during the pandemic as perpetrators used a variety of schemes from fake vaccines to fraudulent unemployment benefits to steal massive amounts of money. It’s so easy to become an innocent bystander or an organizational target, which is why you must be educated on the types of schemes, the red flags missed, and the rationalizations often used to justify these frauds.

5. Embrace the whistle-blower.

Unfortunately, we live in a society where people that attempt to come forward with the truth often get attacked. Remember, all perpetrators are not the same, and this also applies to whistleblowers. In my documentary, All the Queen’s Horses, the fraud was discovered by a whistleblower named Kathe Swanson. She is what I call an accidental whistleblower, someone who was doing their job and stumbles upon a discrepancy during their day-to-day operations. Typically, an accidental whistleblower does not identify as a ‘whistleblower’ because they believe that they are just doing their job, which is why they report what they saw.

Oftentimes, the accidental whistleblower is not ostracized by their community for coming forward. Compare that to a noble whistleblower, who is asked to turn a blind eye or not report wrongdoing if they see it. This brave person courageously steps outside of the group or team to blow the whistle. When they do this, they are greeted with extreme distrust. Like the accidental whistleblower, they don’t naturally identify as whistleblowers and are surprised when they are greeted with rejection. We tend to distrust a person that steps outside of the group even if they are telling the truth.

The last category is the vigilante whistleblower. This is the category that terms like snitch, rat, tattletale, traitor are actually referring to. The vigilante never minds their own business and when they see an injustice, whether it has anything to do with them or not, they are telling. We need all these categories of whistleblowers, as they each play a different and important role in society. When we think of the vital information presented by each of the whistleblower categories, I do hope you can see why it is so important that we create environments where these courageous individuals feel embraced. From Peter Buxton, who exposed that African American patients in the Tuskegee syphilis experiment were left untreated, to Cynthia Cooper who worked to expose the $3.8 billion fraud at WorldCom, whistleblowers should be celebrated and not just tolerated.

To listen to the audio version read by author Kelly Richmond Pope, download the Next Big Idea App today: