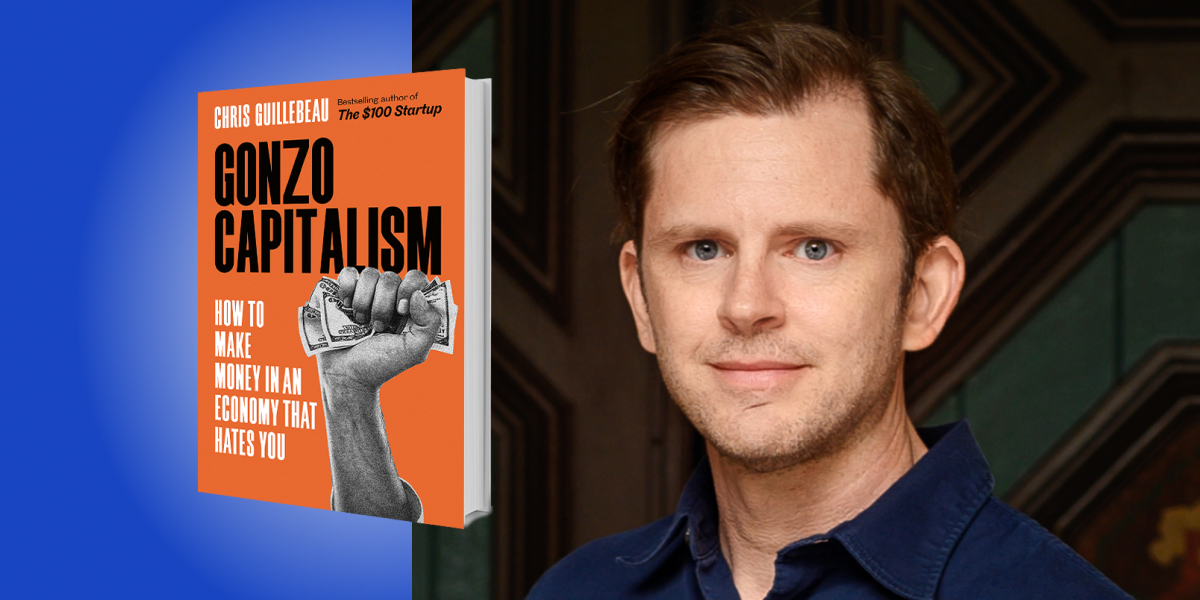

Chris Guillebeau is the bestselling author of The $100 Startup and The Happiness of Pursuit, among others. His writing career really took off after the success of his blog, The Art of Non-Conformity, which was about his use of entrepreneurial savvy to fund his travel dreams.

Below, Chris shares five key insights from his new book, Gonzo Capitalism: How to Make Money in An Economy That Hates You. Listen to the audio version—read by Chris himself—in the Next Big Idea App.

1. We’re now in the age of Peak Marketplace.

Every skill, talent, hobby, or source of knowledge can be monetized. Decentralized platforms allow you to go to market immediately, without banks or other gatekeepers.

I’ve been selling online and immersed in this world for more than 25 years—but I’ve never seen anything like this. Never has there been a time where so much is possible for so many people. In the book, I have a chapter on playing blockchain video games for real money, learning about prediction markets (including betting on elections and Brittney Spears), the astounding universe of the creator economy, and so much more. One of my favorite stories is about an Australian guy named Jakey Boehm. He works the night shift but he tries to sleep through it.

Specifically, Jakey earns a lot of money (up to $50,000 a month) as a “sleepfluencer,” getting paid to “sleep” through the night while streaming on TikTok—viewers can pay to wake him up with all sorts of loud noises and disturbances. He does this eight hours a day and you think it might be crazy—well, it is crazy—but keep in mind that he could always sleep another eight hours a day and keep earning that income.

2. The Money Revolution will change history forever.

I begin the book with two quotes:

Human desire is not an autonomous process, but a collective one. We want things because other people want them. —René Girard

If I’m fake I ain’t notice cause my money ain’t. —Nicki Minaj

If enough people decide something is “worth” more or less than its current value, then suddenly it is. It doesn’t really need to make logical or objective sense. Even money itself is just a matter of perceived value.

This concept got a lot of attention during the beginning of the pandemic economy, where NFTs were selling for millions of dollars and the government kept printing money—but even if some of the early examples seem silly, a transformative effect took hold.

“How can you capitalize on the money revolution?”

Of course, in lots of other ways, money is very real. We need it to survive in the modern world. I have a story about a teacher who now has millions of followers on an account she started during the early days of lockdown. It has completely transformed her life, the project is making a ton of money, and it scaled up very quickly.

The central question of my book is: what’s in it for you? How can you capitalize on the money revolution?

3. You can obtain direct investment for your ideas.

A lot of business ideas don’t require any investment at all—but if you are seeking investment, you don’t need to go to the bank with your hat in hand, or even on Shark Tank.

Consider Alex Masmej, a young guy from France who wanted to move to San Francisco. He received more than $20,000 from direct investors in exchange for a share of his future income. This practice has been happening with professional athletes for a while, or musicians who sell a percentage of their catalog, but what’s new is that now ordinary people can do this.

Or there’s Laura Mayer, who was the top employee at a big podcast studio in its early days, but then grew disillusioned as she missed out on the equity that many of her colleagues received. Instead of complaining, she started a show of her own titled Shameless Acquisition Target, which led to her getting a new job and a book deal.

Something I heard during my research for the book: “It’s easier to get money for your idea than it is to find good ideas to invest in.” The tables have turned. Ideas have currency.

4. Capitalism isn’t ending, it’s just rebranding.

Before I had the title for the book, I wanted to understand why a lot of my readers said they were opposed to capitalism, when that’s the very thing I’ve been writing and podcasting about for years! What I came to believe is that a lot of people just define capitalism differently. The twist is that even as they’re skeptical of the system, many of them are in favor of using it for their benefit.

For example, a twenty‐nine‐year‐old from San Francisco named Demi Skipper conducted a very public barter experiment, starting with a hairpin and trading up to a car and a house and then doing it all over again. In doing so, she took advantage of modern networks, which made her a viral sensation.

“Making money from sponsors or advertising is no longer seen as selling out.”

At one point she said in an interview, “I love that this is an F.U. to capitalism”—but now she runs ads on Instagram for corporate sponsors, who are paying real money. You could be critical of a story like that, but I think what’s more interesting is to recognize how inherent contradictions have been absorbed into a broader definition of capitalism, or “late stage” capitalism as it’s sometimes called. Getting ahead and making money from sponsors or advertising is no longer seen as selling out. In fact, it’s often the goal.

The short of it is: get the bag. What can you do for yourself? My mission is to help people understand that there are alternatives.

5. The “rules” of personal finance desperately need an update.

Over the years, the personal finance industry has changed very little—which has been frustrating. What happens is a few people come along who offer stylistic updates, but they’re still saying the same things as everyone else.

This is also misleading because the stock market hasn’t been around that long. When people talk about historical data, they’re referring to a short time period in which there’s no guarantee that things will continue to plod along the way they have before. You need to position yourself for the world of the future, not the past.

Here are a few of the contrarian suggestions I offer in the book, which will be popular with some people and controversial for others:

- Buy stuff and experiences (you’re not a bad person if you want to buy a new couch)

- Worry less about debt (governments and big companies don’t seem to worry about debt, so why should you?)

- Learn to take asymmetrical risks (where the upside if something goes well is much greater than the downside if it doesn’t)

Not all the suggestions will be for everyone, but I want to help people think differently and consider: what can I do right now to improve my situation? How can I adapt to this new world and build the world that I want?

To listen to the audio version read by author Chris Guillebeau, download the Next Big Idea App today: