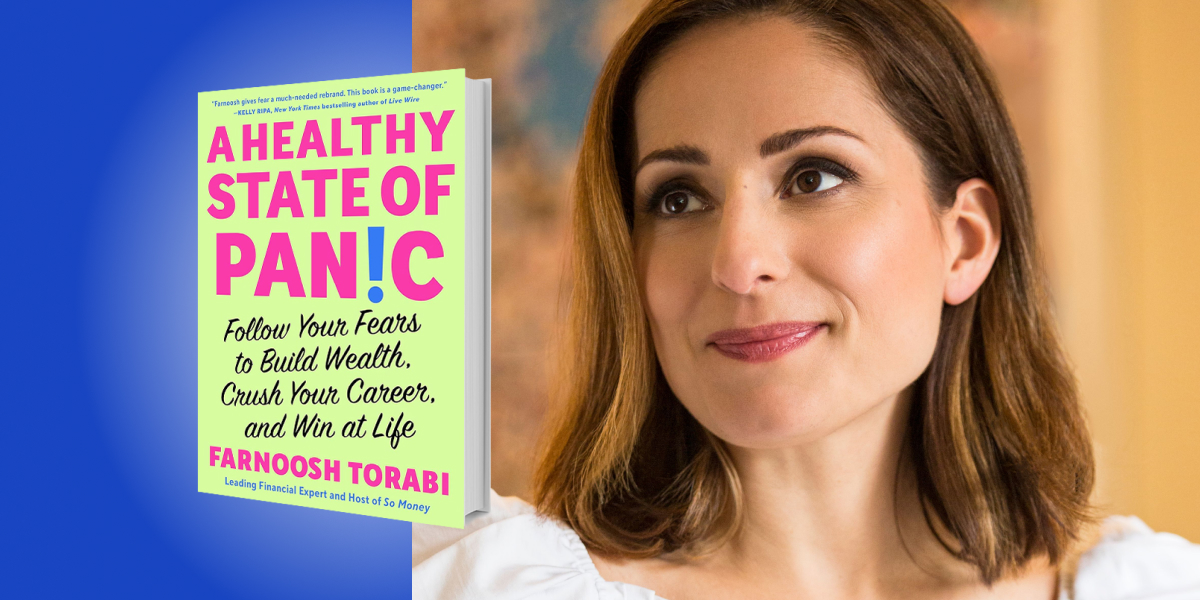

Farnoosh Torabi is an Iranian-American journalist, author, and personal finance expert. She hosts the Webby-honored podcast So Money, which has earned over twenty-five million downloads. She hosts a CNBC program and serves as the resident money columnist for O, The Oprah Magazine. Farnoosh holds a degree in finance from Penn State and a Master’s degree in journalism from Columbia University.

Below, Farnoosh shares 5 key insights from her new book, A Healthy State of Panic: Follow Your Fears to Build Wealth, Crush Your Career and Win at Life. Listen to the audio version—read by Farnoosh herself—in the Next Big Idea App.

1. Fear has been through the ringer.

For generations, fear has been the victim of some unfortunate PR. At least as far back as President Franklin D. Roosevelt’s famous inauguration speech during the Great Depression, where he told financially desperate Americans that “the only thing we have to fear is fear itself,” our world has ventured an aggressive campaign to belittle and undermine our fears. We’re told it’s a barrier to living our best life.

Search for a book with the word “fearless” in the title and tens of thousands of results will surface, featuring war heroes, millionaires, and persistent romantics. Scientists have even invested time and dollars in seeking a “cure” or “conversion” for this awful emotion. A study from The University of South Australia concluded that smiling more is the way to trick the brain into reducing fear.

But what if we give fear a chance? Rather than deny or fight our fears, what if we choose to work with them?

2. Fear can be a friend.

Being a scared young girl and, today, a continuously frightened woman, I’ve arrived at a more optimistic understanding of fear and how it works: it’s not out to get you. It wants a healthy relationship with you so you can reach your greatest potential with a net at your back.

As I mentioned, fear and I go way back. I am the daughter of Iranian immigrants, raised in a country that wasn’t always so welcoming of our differences. As such, my parents encouraged my brother and I to see the world for what it was (and still is): a dangerous, booby-trapped labyrinth. Our family’s ground rules for living a “safe” life were simple: Stay home. But as my mother likes to point out, “It all worked out, didn’t it?” It’s interesting. As life evolved, fear became a wise friend, opening my world, and providing the tools and street smarts to thrive on my own terms.

“What had seemed at first like an excess of fear was actually an essential shield that kept the settlement safe and thriving.”

American primatologist Dian Fossey understood this. She was known for her groundbreaking research on apes. In one study, she moved around with herds of chimpanzees for years, noting how fear and anxiety were integral to their protection and survival. In each tribe, she inevitably discovered a small subset of more concerned chimps that tended to stay on the outskirts of the settlement. They insisted on lying awake to survey the land for predators. As an experiment, Fossey removed the anxious chimps from their tribe. Several months later, their community was obliterated. What had seemed at first like an excess of fear was actually an essential shield that kept the settlement safe and thriving.

Modern science reinforces the merits of siding with fear. A 2023 study led by academics in the fields of brain science and psychology found that those who viewed emotions like fear, anger, and sadness as bad or wrong were unhappier than people with a positive or even just neutral relationship to these “negative” feelings.

So, when fear arrives, it can be exciting. Fear has key insights to share about you, your goals, and what you hold dear. When you process and learn from fear, it can bring you safety, satisfaction, and all kinds of success. This is an opportunity you can’t afford to miss.

3. FOMO Is a call for self-reflection.

The fear of missing out, or FOMO, is a complex and deep-rooted fear. We know it as the uneasy, threatening, and sometimes all-consuming feeling that you’re not doing what’s expected of you. FOMO hits where it hurts: our sense of self-worth and accomplishment. The funny thing about FOMO, though, is that if you can learn not to give in to it and follow the herd, this fear can lead you inward, to tap what is already inside and leverage it in a purpose-driven way.

I experienced this first hand when I grappled with a fear of missing out on the online course market. When so many online entrepreneurs started making massive dollars by selling digital courses, I questioned my own business model. Up until that point, my company had been mainly built on writing, speaking, and working with brand clients. These online entrepreneurs—some of them my friends—made the virtual course world seem so simple and rewarding. If you weren’t selling digital workshops or online courses, then you were leaving money on the table. Or that was my fearful inference.

“When FOMO flares up in your life, engage this fear in some healthy interrogation.”

At first, I gave in. I attempted to create a course, and immediately regretted it. It was not easy. It was not a four-step process like all the courses on how to build courses had promised me. In the end, I wasted many hours and dollars investing in the concept.

When I sat with my FOMO, I realized what had drawn me to this course trend was the concept of being more in control of my time and income. Was there another way to pursue this desire that was more in line with what I enjoyed doing? Yes. The answer was a high-touch, in-person workshop for a small number of guests, the antithesis of an online course that relies on needing scale. When I did the math, my profit margins were better than building a course. My participants were willing to pay five times more than what they would online and I filled the event mostly through word of mouth—no need to spend thousands on Facebook ads.

When FOMO flares up in your life, engage this fear in some healthy interrogation. Find a more personally aligned alternative. What activity, ritual, or way of living is more rewarding and meaningful to you? Use FOMO to ditch the trendy script and do what you do best.

4. Your fear of uncertainty has the potential to inspire new pathways.

Uncertainty is the only certainty in life. It’s a fundamental law of nature that the level of disorder in our world is steadily increasing. As the daughter of a physicist, I feel this in my bones.

This fear of uncertainty is fundamental to the human experience. Research shows that any aspect of unpredictability makes us painfully uncomfortable. One experiment showed that when people knew, with certainty, that they would be electrocuted, they exhibited less stress than when they knew there was a 50 percent chance of receiving a shock. That’s dark, I know. But it illustrates just how determined the fear of uncertainty can be and how it can fuel anxiety to the point of illogic.

This fear runs deep for most of us. For me, the fear of uncertainty has been a longtime companion with a surprising upside. It signals to me to pause, reflect, and gather information, and then diligently work our way through the fog.

Back in 2009 when I got laid off from my job as a senior correspondent at a media company, I disconnected from the outside world for a little while. I was in denial and embarrassed. But my fear of uncertainty kept me awake and the wheels in my head turning, asking Farnoosh, what are you going to do? The fear taught me what I know today: remember who you are, your ambitions, your gifts, and what you’re capable of. These are the unshakeable truths that will propel you to greatness in uncertain times.

“Remember who you are, your ambitions, your gifts, and what you’re capable of.”

This fear gave me the kick in the pajamas I needed to take inventory of all of that: I was a woman who could demystify the world of money. That wasn’t a small thing. I had many sources and relationships in the media. I wasn’t afraid of hard work. I knew how to write. I knew how to talk in quippy soundbites on TV. I knew how to operate a camera. I was also very good at things like facing rejection and being alone. So, that summer, I started my own media business out of my studio apartment. I leveraged what I could. I created my own order in the disorder, as opposed to waiting for someone to hire me and provide me with the stability I craved. Really, that pink slip, while it took away my title and salary, also highlighted all the things it couldn’t take from me. And those certainties were my ticket to venture out on my own.

For all of us, the fear of uncertainty can instill determination, a quench for finding solutions, and a penchant for being able to count on the self above anyone else. This fear can help you harness and grow what you have worked so hard to cultivate: your resourcefulness and instincts.

5. Fearing the financial worst can help you reach your fiscal best.

Researchers have found the thought of losing money to be naturally associated in the brain with fear and pain. While it may seem cruel to say, this can be powerfully beneficial in real life. Why? Because when we feel pain, we want nothing more than a real, lasting cure.

It’s a healthy practice to really let yourself face your very worst money-related fear. Don’t just throw out the expression “What’s the worst that can happen?” Look into it: What is the worst that can happen? See it. Feel it.

New moms often write to me, contemplating quitting their careers to become stay-at-home parents. They’re afraid of trusting a part-time caregiver or the daycare down the road and worried how a full-time career might compromise their ability to be present as a mom. Not to mention, they’re afraid that the cost of childcare would stretch the family budget too thin.

One mom told me that her partner was happy to take on the role of sole financial provider. This gave her some reassurance to quit. But she was still torn. She explained her fears of giving up her income and profession—after working so hard to arrive where she was—and how it might impact her independence and options down the road. She was full of apprehension and doubt. I assured her that what she was fearing was spot-on. She should give these money fears some real space. She would benefit from letting this fear drive her to have a conversation with her husband and understand what her fears might be communicating about her security and livelihood. What scared her more—not spending as much time as she imagined with her child or not having a career that might provide more financial independence for her and her family?

“Fearing the financial worst due to uncertainty may lead us to save more in an emergency account, earn more, pay off debt faster, or cut expenses.”

This particular financial fear of being unable to simultaneously pursue a career or job and parent successfully—especially the terrifying math of how expensive childcare can be—has the tendency to convince moms they should abandon the workforce to be the primary and full-time caregiver. The fear can lead us to only see dead ends. Moms don’t see a path where they can prioritize their financial well-being and be the actively engaged parents they want to be.

To this mom and all frightened new moms and moms-to-be hoping to use their fears in a constructive way, I say this: Go to the edge. You’re afraid right now of the present day and the beginning weeks and months of being a new parent. But let’s examine a far scarier scenario. What if you get divorced and risk becoming a single parent who, because she didn’t earn money during the marriage, has no savings to pay for legal fees and her own expenses? What if you become a widow, and there’s not enough money in the bank to support your family? What if you simply decide, five years from now, that you want to reclaim your professional life. How will you be able to find a new job as a parent who’s been out of the workforce for several years?

Give this fear the depth and respect it deserves. From that vantage point, you can discover a secure strategy forward. Before this new mom took a leave of absence, I suggested that she protect her financial autonomy by securing her own savings, and we developed a plan for her to ramp back into the workforce within a couple of years.

For some of us, fearing the financial worst due to uncertainty may lead us to save more in an emergency account, earn more, pay off debt faster, or cut expenses—moves that are more within our control. At the end of the day, this fear wants you to take inventory of what you value and from there, determine the most practical ways to preserve it.

To listen to the audio version read by author Farnoosh Torabi, download the Next Big Idea App today: