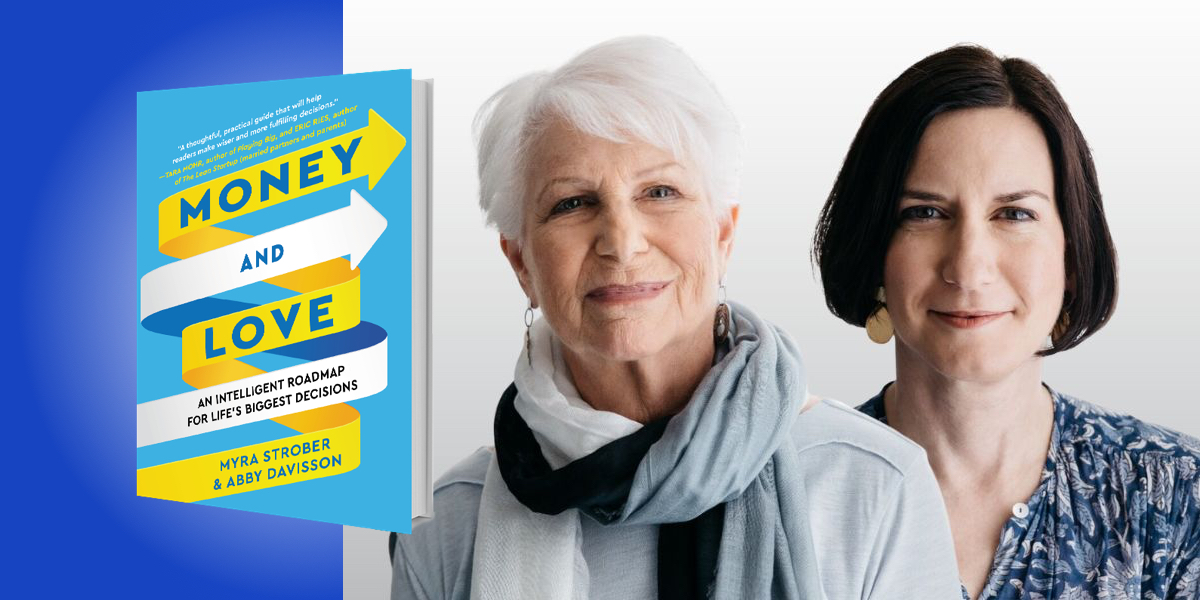

Myra Strober is a labor economist and former Stanford Professor Emerita at Stanford Business School. She was the founding director of the Stanford Center for Research on Women (now the Clayman Institute for Gender Research) and the first chair of the National Council for Research on Women.

Abby Davisson is a social innovation leader and career development expert. She was formerly the President of the Gap Foundation, and co-founded the employee resource group for working parents at Gap Inc., which has been featured as a best practice for how employers can support dual-career couples.

Below, Myra and Aby share 5 key insights from their new book, Money and Love: An Intelligent Roadmap for Life’s Biggest Decisions. Listen to the audio version—read by Myra and Abby—in the Next Big Idea App.

1. Decisions about money and love are profoundly intertwined.

Conventional wisdom teaches us that we should take completely different approaches for these two topics. We often get advice to not let money concerns influence our decisions about love, and never to allow love to influence our decisions about money. Yet these decisions affect each other and compartmentalizing them does us a great disservice. When we acknowledge that life’s biggest decisions involve both money and love, considering them jointly allows us to make better decisions that leave us happier and more fulfilled.

Take the decision about where to live and when to move. It’s not just about money and it’s not just about love. How about having children while pursuing a career? Again, not just about money or love. Thinking about big decisions holistically yields significantly better results.

For example, before accepting a new job, consider how that job will impact your relationships—because it will, whether you anticipate it or not. Before agreeing to spend the rest of your life with someone, think about how that decision might affect your career and your finances—because it will. The more you think about it in advance or talk about it with the person with whom you’re considering spending the rest of your life, the better off you’ll be.

2. Money and love decisions shouldn’t be made in haste.

Humans don’t like uncertainty, and we often just want to get a decision over with—but rushing can lead to regret. Sometimes big emotions, like anger, fear, or guilt can make us rush into decisions. Take Lisa, who lived in Florida, where she had worked for the same company for three years, and had a girlfriend she lived with and had been dating for the same amount of time.

“Major decisions rarely need to be made in an instant.”

Lisa had recently gotten a new boss, and unfortunately things weren’t going well. She felt like she was on rocky ground at work, so she responded to a cold email from a recruiter and began interviewing with a new company in Chicago. One day, she received a negative performance review from her boss, and a few hours later, she got a job offer from the other company. Angry about the negative review (her first ever,) Lisa called her boss back and gave notice that same day.

She thought her girlfriend would be supportive, especially since the new job came with a big raise, but later that day, when she told her, her girlfriend was shocked. It was true that the extra money would be helpful, but this involved uprooting their lives, and they had only been to Chicago once on vacation. Instead of being excited, Lisa felt sheepish and wished she’d handled things differently.

Major decisions rarely need to be made in an instant. By taking our time, we increase the likelihood of making sure we’ve thought through all the angles needed to move forward with confidence.

3. Slow down your decision-making by going through each step of a specific process when facing a big decision.

Our decision-making process is called the 5Cs, and it covers all the bases when making a big life decision. The first C is to clarify what’s most important to you, which you do by thinking carefully about what you care about and what you don’t. Untangling your wants from others might be harder than it seems, thanks to something called mimetic desire. This concept, coined by French philosopher Rene Girard, means that what we want is powerfully influenced by what others want—and sometimes we don’t even realize it. For example, you might be very happy renting an apartment, but if all your friends start buying their own places, you may start feeling like you’re “behind” because you haven’t bought a place of your own. High achievers are especially susceptible to putting things on their life lists just because society thinks they should.

As part of clarifying what’s important, many people find it helpful to identify their core values, the deeply held beliefs that are central to who they are. Core values can serve as a helpful compass along the money and love journey.

“High achievers are especially susceptible to putting things on their life lists just because society thinks they should.”

Once you’ve clarified what’s most important to you, you’re ready to tackle the other Cs. The remaining four Cs are: Communicate with those most affected by your decision; Generate a broad range of Choices; Check-in with friends, family, and trusted resources; and explore your decision’s possible Consequences—long-term as well as short-term consequences.

The 5Cs won’t give you the answer and it won’t guarantee that you’ll make the “right” decision. Life will certainly still throw monkey wrenches at you, but you’ll feel more confident and in control over the way you made the decision. You’ll also be less likely to second-guess yourself.

4. When communicating, tread lightly, listen, and give grace.

The second step of our 5Cs framework is to communicate with those most affected by the money and love decision you’re considering. Humans are social creatures and most of our big life decisions are going to have an impact on others. This is why talking about them with others is important, even if it seems like the decision affects only us.

Big decisions are fraught topics, and we need to tread lightly. For example, be sure to tell the person or people involved that you have something important you would like to discuss. Agree on a time and place to talk before launching into the conversation. Serious topics deserve a private venue with enough time to consider points and counterpoints. Don’t raise the topic nonchalantly when you’re brushing your teeth at the end of a long day. Try discussing heavy topics on a hike. Getting out in nature, away from the chaos of our everyday lives, helps us to think more expansively.

When talking to loved ones about big decisions, it’s important to listen empathetically and without interruption. Leave your phone in another room, and when you’ve said your part, let the other person speak for as long as they need to without cutting them off.

“Getting out in nature, away from the chaos of our everyday lives, helps us to think more expansively.”

Lastly, give grace. These conversations might be awkward and uncomfortable. In fact, they’re likely to be. If things get heated, you can always come back to the conversation when things are calmer. If you give your partner grace, and somehow muddle through, you’ll find the conversations get easier over time.

5. Small actions make a big difference in changing sub-optimal choices related to money and love.

One of the reasons so many people struggle with money and love decisions is that our society (particularly in the United States) isn’t well set up to support the pursuit of both. Our laws, policies, and culture don’t prioritize or value caregiving. Those of us in caregiving roles—the majority of workers in the U.S.—are left feeling stuck.

Individuals can help change the work/family system, because it’s not enough for us to solve our money and love issues on an individual level. In order for true change to happen, our laws, institutions, and communities need to change as well. We will all be better off when that change happens.

Separately, we can all see opportunities to build communities that could create more impact collectively than we could as individuals. We can bring in allies, and together make the business case to our employers. The communities we build can endure and continue to lead important work. Change agents play a critical role in spurring our society to adapt to our fast-changing world. We all have the ability to be change agents, both in our own lives and beyond.

To listen to the audio version read by authors Myra Strober and Abby Davisson, download the Next Big Idea App today: