Ebony Reed is a community news journalist. She began her career as a reporter at Cleveland’s The Plain Dealer, and then covered the 2008 economic crisis for the Detroit News. She has held senior roles at the Associated Press, Boston Business Journal, and the Wall Street Journal and taught at more than half a dozen institutions, including The Yale School of Management. Now, she is the Chief Strategy Officer at The Marshall Project, a nonprofit news organization covering the U.S. criminal justice system.

Louise Story is an investigative reporter and financial journalist. She spent over 15 years at the New York Times and the Wall Street Journal, where she was the top masthead editor running coverage strategy. Her work investigating corruption led to the largest kleptocracy case in U.S. History, known as the 1MDB case. Her investigation of Wall Street and the derivatives market led to a multi-billion-dollar settlement. And her investigation of Goldman Sachs during the 2008 financial crisis led to the bank’s S.E.C. settlement. She has won numerous honors, including Emmy Awards, Pulitzer Prize finalist citations, and Online News Association Awards. She teaches at The Yale School of Management.

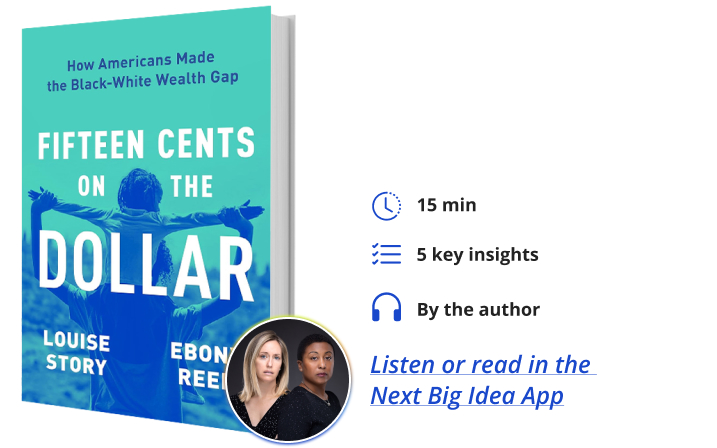

Below, co-authors Ebony and Louise share five key insights from their new book, Fifteen Cents on the Dollar: How Americans Made the Black-White Wealth Gap. Listen to the audio version—read by Ebony—in the Next Big Idea App.

1. People are confused about what wealth is.

If you ask people to define wealth, their answers are all over the place. Some confuse wealth with income, or the amount you get paid at work. Some include intangible things like education, health, and happiness in definitions of wealth. Some describe assets like houses but forget those houses often are mortgaged. Some say wealth is power. Even the MBA students we teach at Yale University gave us a range of answers when we asked them to define wealth.

So, what is it? Wealth is what you own minus what you owe. Or, as the U.S. Federal Reserve says, it is the value of all your assets minus your liabilities. Because people don’t understand wealth very well, they don’t understand wealth gaps.

2. Fifteen cents on the dollar should be a nationally recognized statistic.

Fifteen cents on the dollar is the amount of money a typical Black family has compared to one dollar in wealth held by the typical white family. This ratio is true for both the average and median Black families, compared to the average and median white families. This figure is about where it was 70 years ago, before the Civil Rights Movement took off.

The lack of public knowledge about this data point motivated us to write this book, and our number one goal is to make fifteen cents on the dollar a nationally recognized statistic. Just like new conversations in recent decades about the gender pay gap, we think that making this data point of the Black-white wealth gap well-recognized and better understood can help communities, companies, and people all over the country. It will change conversations about housing, banking, education, DEI programs, healthcare, taxation, the Justice System, and many other areas.

3. Whether you are white or Black or some other race, this is history you should know.

Fifteen Cents on the Dollar explores essential chapters of financial history that led up to today’s economic disparity: slave-based insurance and banking, Freedman’s Bank, land grants and losses, the creation of the middle class, how Black Americans were left out of New Deal programs, the modern opportunity era (that we have been in the past 40 years), and why the Black-white wealth gap didn’t move much despite programs like affirmative action.

“This figure is about where it was 70 years ago, before the Civil Rights Movement took off.”

Of special will be our section on the 2008 financial crisis. Louise covered the Wall Street side of this crisis in 2008 while at the New York Times, and I covered the on-the-ground repercussions as an editor at The Detroit News. We looked back at this period with a longer lens and see lasting consequences with racial contours today.

4. The absolute dollar amount is hard to move, and the time until the gap closes is long.

Many readers will find it surprising how little the Black-white wealth gap has moved in modern history. And it’s unlikely to close in the near future. We feature some calculations that show, at current rates of change, the gap will take on the order of 100 years or more to close. As things stand, typical Black families will likely have a fraction of the wealth of typical white families for generations.

We don’t share these numbers to be negative. However, people often think that a few corporate DEI programs or new college scholarships will close the gap by the time their children become adults. A dose of realism is needed about the vastness of the gap and how pervasive it is in just about every aspect of business, politics, and the economy.

5. We have all been affected by racial gaps.

For all the data points, it’s people who have been affected by the Black-white wealth gap. We go behind the scenes on the financial history of Michael Render—better known as the Grammy-winning rapper Killer Mike—and his family, as well as the financial history of Civil Rights leader and former Atlanta mayor Andrew Young and, finally, the story of entertainment executive Ryan Glover.

We follow the stories of four lesser-known Black Millennials working hard to change their families’ wealth trajectories but hitting barriers. Among these Millennials, you’ll meet Tandreia, a technology worker from rural North Carolina who can’t afford to live in Atlanta. And James Lovelace, a victim of a rent-to-own contract in Atlanta who loves his home and fights for it. And James Woodall, a rising star in the NAACP, who runs into issues because he’s not from the Black elite. And Brook Bacon, a Black man married to a white woman in New Hampshire who had left his Black roots behind… that is, until his father got shot by the police in the summer of 2020.

“We all stand on the shoulders of the generations who came before us.”

All these people will move your hearts and spur new questions about how our economy works. By the end, you will have gone on a journey and likely thought about your own family and where they won or lost out in economic strides and bounds. We all stand on the shoulders of the generations who came before us, and this book will help you better understand the economics, dreams, and challenges of people around you.

One personal recommendation we make is: more people should find a meaningful project in their lives in which they can partner with someone very different from themselves. The two of us are an example of this: Louise is a white woman who lives on the East Coast and is married with children. I—Ebony—am a Black woman who lives in Kansas City, Missouri in the middle of the country, and I am a widow with no children.

We share many values and outlooks, but our lived experiences and races are different. We were committed to a true partnership on this book, and to create that, we had to understand each other a lot better. We had to understand the time commitments and economics of each of us. And we had to ask questions like: Is it equitable for us to put in the same amount of money or time when we have different amounts of money and time available? We sorted through all this together, and along the way, we listened and learned.

If more people in this country make it their business to deeply connect with people across racial lines and partner with individuals different from them, it could affect many broader conversations.

To listen to the audio version read by co-author Ebony Reed, download the Next Big Idea App today: