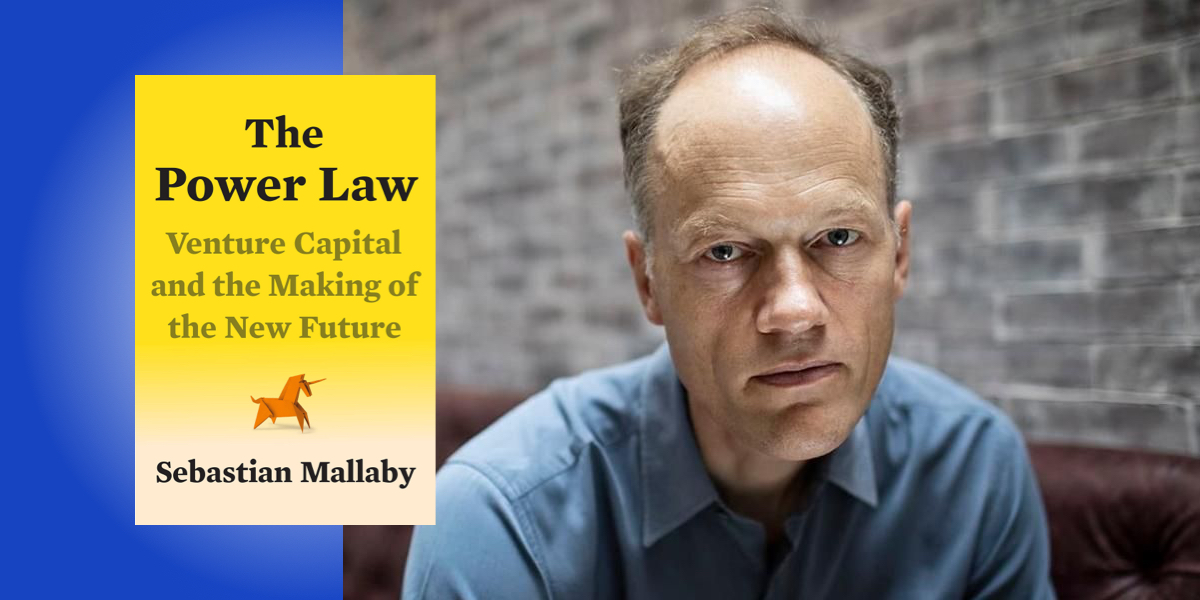

Sebastian Mallaby is the author of several books, including More Money Than God, The Man Who Knew, and The World’s Banker. A former Financial Times contributing editor and two-time Pulitzer Prize finalist, Mallaby is the Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations.

Below, Sebastian shares 5 key insights from his new book, The Power Law: Venture Capital and the Making of the New Future. Listen to the audio version—read by Sebastian himself—in the Next Big Idea App.

1. Prediction is overrated.

Vinod Khosla, one of Silicon Valley’s most successful venture capitalists, likes to say that the future cannot be predicted; it can only be invented.

When people predict the future, they usually do so by studying patterns from the past. An economic forecaster, for example, might analyze past data and see that a spike in job creation is generally followed by a rise in wages. Therefore, the forecaster will predict wage trends tomorrow based on what’s going on with job creation today. Similarly, a criminologist might look at job creation to predict crime rates. If the historical data show that higher unemployment means more muggings, the criminologist will predict that this pattern will hold in the future. More jobs, safer streets; more unemployment, more law-breaking.

But now think back to Vinod Khosla. What he is saying is that these social science extrapolations are just not very interesting. They anticipate the future only when there is not much to anticipate. If tomorrow will be a mere extension of today, why bother with forecasting?

The forces that really shape the future—and in particular, the inventions that disrupt economies and societies—are not mere continuations of the past. By definition, path-breaking new technologies break with past trends. Far from conforming to historical patterns, they scramble them.

Think about the COVID-19 pandemic: a social scientist could have looked back at past pandemics and attempted to build predictions based on historical experience. But this would not have anticipated the remarkably speedy invention of effective COVID vaccines, which fundamentally changed the course of the pandemic.

You might say, “Well, the forecaster’s job was to predict the vaccines, but anticipating unprecedented technological breakthroughs is just about impossible. Inventions bubble up from the primordial soup of tinkerers and hackers—you can’t predict what’s going to surface next. All you can know is that the world of tomorrow will be excitingly different.”

Hence the first big idea I want you to think about: things that are probable, based on extrapolations from past patterns, are not especially significant. In contrast, things that are improbable can change everything.

“Things that are probable, based on extrapolations from past patterns, are not especially significant. In contrast, things that are improbable can change everything.”

2. Not everything is “normal.”

Many phenomena in life follow what statisticians call a “normal distribution,” meaning that nearly all the observations in a data set cluster around the average. For example, the average height of an American man is 5’10”, and two-thirds of American men are within three inches of that average. What’s more, the exceptional men are not actually all that exceptional. A seven-foot NBA player might sound like a giant, but in fact, he’s only 20 percent taller than the 5’10” average.

Not all phenomena follow this pattern, however. If we switch the discussion from height to wealth, we confront a totally different distribution. People who are richer than the average are sometimes vastly richer. Billionaires are about as rare as seven-foot-tall people, but relative to the average American family, a billionaire is 1,300 percent wealthier.

This sort of skewed distribution is an example of the “power law,” so called because the winners advance at an exponential rate, so that they explode upward far more rapidly than in a simple linear progression. Once you become a millionaire, your opportunities for further enrichment are multiplied. Become a billionaire, and your opportunities expand exponentially.

Getting our minds around power laws and exponential growth is notoriously difficult. Let’s go back to the COVID-19 example—at the start of the pandemic, it was hard to understand that an apparently trivial doubling in the daily infection rate from, say, two people to four people in 100,000 would become a very big deal when the rate was doubling from 2,000 to 4,000.

But venture capitalists can help us comprehend the power law because they grapple with it daily. The vast majority of the startups that they back end up failing, but a small minority get on the exponential curve—and the best performers generate more profits than the rest of the startups put together. It’s a highly skewed distribution. “Venture capital is not even a home-run business,” the venture investor Bill Gurley once remarked. “It’s a grand-slam business.”

So the second big idea is that not everything is “normal”—and that, if you are operating in a power-law world, you need to act accordingly. Venture capitalists are constantly backing crazy, ambitious projects—flying cars, cryptocurrencies, futuristic visions of superfast broadband—but that is because they really have no choice. To link back to the first big idea, improbable projects are the only ones that have a chance of hitting the proverbial grand slam. And in a power law world, the alternative to a grand slam is failure.

“The vast majority of the startups that they back end up failing, but a small minority get on the exponential curve—and the best performers generate more profits than the rest of the startups put together.”

3. Don’t be embarrassed.

We know from behavioral science that people have “loss aversion”—they will gamble to avoid a loss, but they won’t take an equivalent risk when reaching for the upside. In a power-law business such as venture capital, this loss aversion is a major obstacle. Venture capital is all about reaching for the upside—reaching for that improbable idea that can deliver a return greater than hundreds of other ideas put together. So venture capitalists have had to figure out a way to overcome their natural loss aversion.

How do they do this? The founding fathers of West Coast Venture Capital understood the answer intuitively. They grasped that the best way to manage power-law risk is to embrace it fearlessly. There is no point trying to back conservative startups that will hit singles and doubles, because in a power-law distribution, these barely exist. So the early pioneers of venture capital gambled aggressively in pursuit of audacious grand slams.

Recently, the venture partnership Sequoia Capital has battled loss aversion more directly. When a Sequoia partner writes an investment memo, he or she is required to include a section on what might happen if everything went right. They have to describe how insanely great the startup could be in the best possible scenario. By building this exercise into their process, the Sequoia partners have given themselves permission to voice their excitement about a deal, and to do so with a fullness that would otherwise be uncomfortable. The idea is that Sequoia won’t shy away from moonshot bets if the cosmic potential is spelled out in writing.

Describing this innovation to me, the Sequoia partner Jim Goetz put it this way: “We all suffer from the desire not to be embarrassed. But we’re in the business of being embarrassed.” So when you are sizing up a decision that will be affected by the power law, don’t let yourself feel embarrassed.

4. Culture is malleable.

I recently had a conversation with a venture capitalist from India. He had attended an elite business school in the United States and worked at the semiconductor giant Intel. In 2010, he returned to India and began to invest in startups. I asked him, “What’s the difference between the Indian startup scene in 2010 and the Indian startup scene of today?” And he told me a story.

“If Indian fathers-in-law can do a cultural 180, so can Europe.”

In 2010, he had backed a company founder, and after a few months, this founder had come to him for help. “I want to marry my girlfriend,” he said, “but her father believes that entrepreneurs are, by definition, losers—so he won’t let the marriage go ahead. But you, Mr. VC, you have a business degree from the United States, you’ve worked at Intel, you have standing. If you call my prospective father-in-law and tell him that ‘entrepreneur’ does not equal ‘loser,’ then he’ll grant me permission to marry his daughter.” So the VC made the call, explained that “entrepreneur” does not equal “loser,” and the marriage went ahead.

I asked my VC friend, “Does this still happen? Are you still called upon to provide marriage intermediation services?” The VC said, “No. Today, all the prospective fathers-in-law in India are watching the venture-capital TV show Shark Tank—and they are watching it in Hindi.”

The point of this story is that culture changes. Back in 2010, Indian culture was suspicious of entrepreneurs. Today, it embraces them. And this is wonderfully good news for the rest of the world, because it suggests that startup networks can succeed almost anywhere.

I’ve given venture-capital talks in Europe, and my audiences always tell me that the risk-taking culture of Silicon Valley will never be replicated in London or Berlin or Paris. But I tell them they are wrong—if Indian fathers-in-law can do a cultural 180, so can Europe.

In fact, Silicon Valley itself demonstrates how culture is adaptable. Back in the 1950s, when venture capital got going on the west coast, the classic business book was The Organization Man, a description of an industrial culture in which white-collar workers joined hierarchical companies and toiled loyally until retirement. There was not much culture of entrepreneurship in the United States back then. But all of a sudden, venture capital began to liberate talent from corporate hierarchies and demonstrate how entrepreneurship could succeed spectacularly. And pretty soon, the culture shifted.

5. Capitalism’s third pillar.

The Nobel Laureate Ronald Coase identified two great institutions of modern capitalism: markets, which coordinate activity via price signals; and corporations, which do so by assembling teams of workers. But it seems to me that networks of venture capital-backed startups deserve to be recognized as the third great pillar of capitalism.

“This blend of venture strategizing and market signals has been extraordinarily productive. Venture capital-backed startups have delivered more progress in applied science than any kind of rival.”

Let me explain—venture capitalists have wrapped their minds around the four big ideas I’ve mentioned so far: first, venture capitalists know that improbable ideas can be the most significant, and that the future cannot be predicted, but it can be invented.

Second, venture capitalists know that the power law dictates extremely skewed outcomes, reinforcing the case for backing improbable moonshots with potentially huge payoffs.

Third, venture capitalists have learned how to fight the behavioral biases that impede power-law thinking.

And fourth, venture capitalists understand that culture adapts, so it’s worth spreading venture methods everywhere.

By mastering these four ideas, venture capitalists have created a form of business activity that sits between Ronald Coase’s two pillars of capitalism. Venture capitalists channel capital, talented employees, and large customers to promising startups; in this way, they replicate the team formation and strategic vision to be found in corporations. But by limiting the amount of money they hand out each time, venture capitalists force startups to raise fresh capital every few months, and this brings a market test into the process. If investors don’t bid for the next tranche of the startup’s equity, the price signal does its work; the startup will close, avoiding the waste of resources that comes from backing R&D beyond the point at which success appears plausible.

This blend of venture strategizing and market signals has been extraordinarily productive. Venture capital-backed startups have delivered more progress in applied science than any kind of rival: more than centralized corporate R&D units, more than isolated individuals tinkering in garages, and more than government attempts to pick technological winners.

Because venture-backed startups have proved so fertile, they have changed how people work, socialize, shop, and entertain themselves; how they access information, manipulate it, and arrive at quiet epiphanies; in short, how they think.

So venture-backed startups should be given their due. Venture capital should be recognized as capitalism’s third pillar.

To listen to the audio version read by author Sebastian Mallaby, download the Next Big Idea App today: