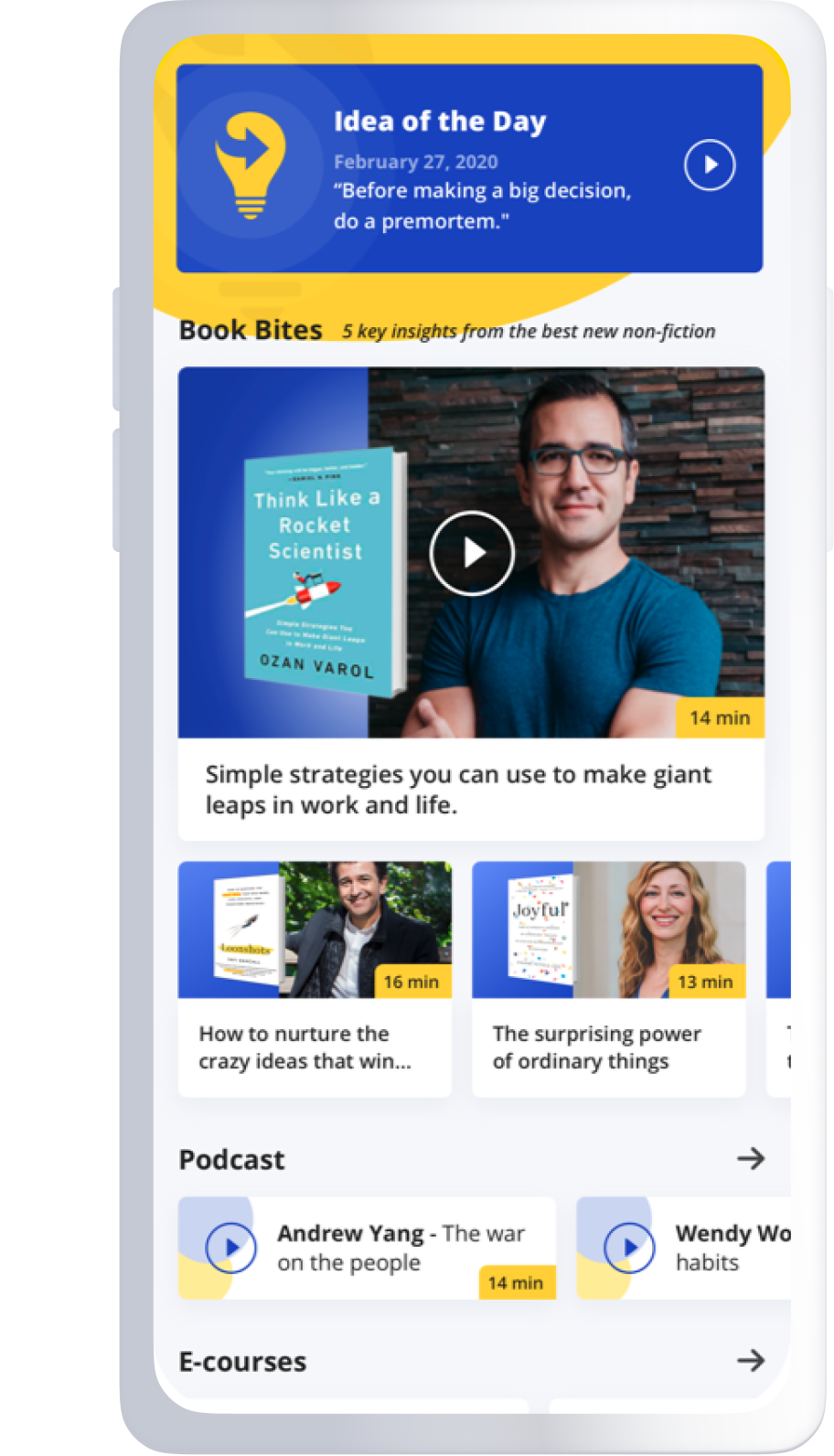

Below, Megan Gorman shares five key insights from her new book, All the Presidents’ Money: How the Men Who Governed America Governed Their Money.

Megan has spent her career working with wealthy individuals and learning the skills needed to build wealth in the United States. She is the founder and managing partner of Chequers Financial Management. The first twelve years of her career were spent as a Vice President at Ayco, a Goldman Sachs Company, and then she became Vice President at BNY Mellon Wealth Management prior to launching her own firm. She is a senior contributor at Forbes, where she writes on personal finance and income tax. Megan is currently on the Board of Trustees for the National Endowment for Financial Education (NEFE).

What’s the big idea?

The money dramas that plague us today are tales as old as time. We share all the same personal financial issues of the present with Americans of the past—including presidents. History is filled with relatable stories of money management (and mismanagement). How do your wealth building skills compare to that of our nation’s presidents?

1. What creates financial harmony in a partnership?

Marrying up can be a good thing for personal finance—but just make sure you have similar values. Some of our most successful presidents have married women who came from a higher socioeconomic status than they did. The list is unbelievable:

- George Washington

- Abraham Lincoln

- Dwight D. Eisenhower

- Lyndon B. Johnson

- Bill Clinton

And that’s just to name a few. But keep in mind, it isn’t all about the money. In personal finance, shared vision is key. Jimmy Carter and his wife Roselyn didn’t always see eye-to-eye. When he decided, upon his father’s death, to move back to Georgia to take over the family farm, Roselyn wasn’t happy. She wanted to stay in New York and have him continue his career as a nuclear engineer in the Navy. But in managing the farm, they were aligned on building a business that supported not just the Carter family but their community. And Roselyn was a very good bookkeeper—Carter was lucky to have her.

In comparison, the Lincolns were a bit mismatched financially. Abraham Lincoln did not come from money and understood that it was important to be a saver. In fact, he saved part of every single one of his presidential paychecks in treasury notes and bonds. His wife, Mary, grew up in a wealthy Kentucky household, and she would often spend and then hide the bills from her husband. While Lincoln was saving, Mary was racking up huge debts. Unfortunately, for the Lincolns, this financial infidelity was never fully resolved due to Lincoln’s early death by assassination.

2. How to set yourself up for a lucrative retirement.

For a large part of American history, presidents left office and either wrote a book, went back to practicing law, or simply died. But one president changed the whole dynamic: Gerald Ford. Now, Jerry Ford wasn’t president for a long time. He was what we would call an “accidental president” as he succeeded Richard Nixon when he resigned. When Ford lost the presidency to Jimmy Carter in 1976, he realized he had to figure out what he was going to do next.

He was still young, in his early 60s, and didn’t want to play golf every day. So, he connected with a gentleman named Norman Brokaw, who was a talent agent at William Morris Agency. The two of them put together a retirement strategy:

- First, Jerry and his wife, Betty, would do a joint book deal (the first joint book deal ever for a first couple).

- Second, Jerry would give speeches.

- Third, there were entrepreneurial endeavors, such as serving on the boards of publicly traded corporations.

Jerry Ford, who left the White House with just a couple of hundred thousand to his name, embarked on this strategy. When he passed away in 2006, his net worth was well over $6 million.

3. Education has always been hard to finance.

Education funding has always been a challenge throughout American history. We had several presidents who didn’t even go to college, including both George Washington and Abraham Lincoln. However, one of the best ways to illustrate alternative ways to pay for college is by looking at the situation of John Adams and his son, John Quincy Adams.

John Adams was the son of a farmer, and when it came time for him to go to college, he wanted to go to Harvard. John studied diligently, and fortunately, he was accepted, but even then, he still needed help paying for it. So, his father sold land as a way to pay for his son’s education.

“John studied diligently, and fortunately, he was accepted, but even then, he still needed help paying for it.”

Fast-forward to when it was John Adams’ time to pay for his son John Quincy Adams’ college education. While John Quincy Adams had accompanied his father on diplomatic missions to Europe, he attended some university courses. So, John Adams cooked up a plan with his wife, Abigail, in which they decided to approach Harvard University and convince them that not only was their son Harvard material, but because of his experience in university course settings, he should enter as a junior rather than a freshman. Luckily for John Adams, John Quincy Adams scored quite well on his Harvard application. He did enter Harvard as a junior, saving his parents two years of tuition.

4. Money anxiety impacts everyone.

Could you believe that John Kennedy worried about people taking advantage of him and his money? Or that Lyndon Johnson would write to friends about how he was up all night worrying about money? Or that Harry Truman wrote to his future bride, complaining about how hard it was for a man to make a decent living? Money anxiety impacts all of us—even presidents.

We all navigate this feeling of financial anxiety. However, some presidents navigated financial concerns more effectively than others. Ronald Reagan came from a challenging financial background, but as he made his way in the world, he learned an important skill that he inherited from his mother: he was phenomenal at budgeting. During times when money was tight, Reagan relied on budgeting to navigate his financial anxiety. When he married Nancy, they did not have enough money to buy furniture for their new home. Nancy was willing to work with him on his budget and wait to get furniture for them to put in their new house.

5. How to align your charitable giving strategy with your intent.

Many U.S. presidents have been incredibly charitable. George Washington focused on providing education for orphans. Millard Fillmore made sure to support his hometown of Buffalo, New York. But the one president who really changed what charity means was Franklin Delano Roosevelt.

“Many U.S. presidents have been incredibly charitable.”

FDR came for money, and when he was stricken with polio, he started to realize that he could help other people who were suffering from illness. He worked throughout the 1920s to build the Warm Springs Foundation in Georgia. It was not just a facility where people could receive help in treating their polio, but it also became a charitable organization that transformed the way we approach charity.

Over the years, FDR and his trusted aide, Basil O’Connor, focused on building a foundation that would allow a cure for polio to be found. During FDR’s time as president, they launched Birthday Balls, where they would encourage every American to send in 10 cents for the president to put toward polio research. Singer Eddie Cantor helped publicize this fundraising effort, calling it the March of Dimes. This charity work that FDR did transformed the fight against polio. FDR passed away in 1945. 10 years later, the cure for polio was found, and nationwide vaccinations eliminated this harmful scourge that had terrified so many throughout history.

Enjoy our full library of Book Bites—read by the authors!—in the Next Big Idea App: