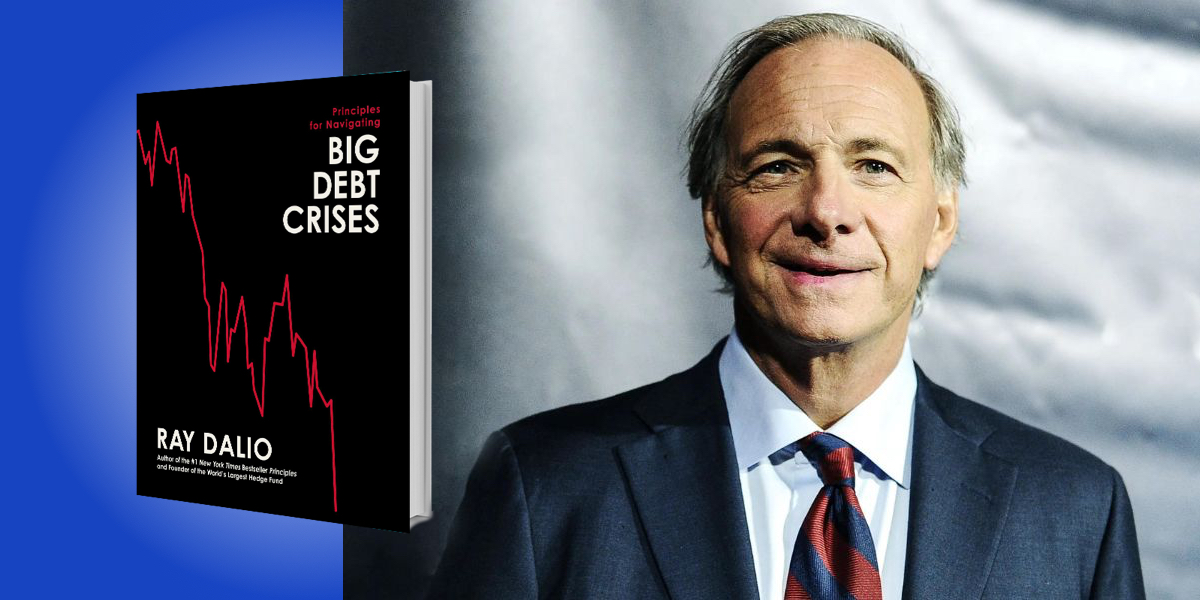

Ray Dalio is Founder, CIO Mentor, and Member of the Bridgewater Board, which, over the last forty years, has become the largest and best-performing hedge fund in the world. Dalio has appeared on the Time 100 list of the most influential people in the world as well as the Bloomberg Markets list of the 50 most influential people. He is the #1 New York Times bestselling author of Principles and Principles for Dealing with the Changing World Order.

Below, Ray shares 5 key insights from his new book, Principles for Navigating Big Debt Crises. Listen to the audio version—read by Ray himself—in the Next Big Idea App.

1. If you understand the major parts and players that make up this repeating cycle, you can pretty well understand what’s happening—and what’s likely to happen next.

There are five major parts. First is goods and services—in other words, the stuff people buy and sell to use. The second major part is money, which is used to buy things, and the third is credit, which is also used to buy things, but the difference between money and credit is that credit creates debt liabilities. The fourth major part is debt liabilities as a piece, such as loans you owe somebody, and debt assets, such as deposits and bonds—in other words, you are owning the asset that somebody will pay you back with. Those are the five major parts.

Next, there are four major types of players. First is those who borrow and become debtors (I’ll call them borrower debtors); those that lend and become creditors (lender creditors), those that intermediate the money in credit transactions between the lender creditors and the borrower debtors (most commonly called banks), and finally, number four is government controlled central banks. These banks can create money and credit in the country’s currency and influence the cost and availability of money and credit. These four players are the biggest drivers of cycles.

2. If you understand the incentives of the major players, it is pretty easy to anticipate what they are likely to do, and how that leads to debt cycles.

It all starts with the difference between money and credit. When somebody uses money in a transaction, that transaction is settled immediately, but when somebody pays with credit, it leaves a lingering obligation to pay that’s called debt. Any two individuals can create debt by one saying to the other, “Pay me later.”

Credit allows borrowers to spend more than they earn, which pushes up demand and prices near term while creating debt that eventually requires the borrowers, who are now debtors, to spend less than they earn to pay back their debts. This reduces demand and prices in the future, creating a natural cycle of stimulation and sedatives for the economy.

“Central banks have a tremendous amount of power because they are the only ones who can create money, making it easier to pay off debts.”

Thus, what’s good for the borrower debtor is often bad for the lender creditor, and vice versa. For example, if interest rates are too high, it will hurt the borrower debtor, and if they’re too low, that will hurt the lender creditor. If either are hurt too much, a debt and economic crisis will occur.

This is where central banks come in. Central banks have a tremendous amount of power because they are the only ones who can create money, making it easier to pay off debts. In the scope of the history of all of the credit cycles, which goes back thousands of years, central banks came into existence relatively recently. For example, the US Federal Reserve was only created in 1913, and their job is to smooth out the boom-bust cycles naturally produced by human psychology. As they do this, over time, environments will shift between those that are good and those that are bad for lender creditors and borrower debtors. And it’s critical for those involved in markets and economies to know how to tell the difference.

3. There are two major types of debt cycles: short-term and long-term.

The big long-term cycles are what lead to what we typically call a big debt crisis. When debt, economic growth, and inflation are growing too fast, central bankers will move to slow these things down by raising interest rates and tightening the availability of money, which discourages borrowing and spending and encourages savings. When debt, the economy, and inflation are growing too slowly, central bankers speed things up by lowering interest rates and easing the availability of money, which encourages borrowing and spending and discourages savings.

These actions create the short-term debt cycles that have historically been about seven years long, give or take three years, which over time add up to the big debt cycles which have been, on average, about 75 years long, give or take about 25 years. Over time, in other words, from one short-term debt cycle to the following ones, debt assets and liabilities tend to rise until they become too large relative to the incomes, and then they come tumbling down in big debt and economic crises.

“Debt assets and liabilities tend to rise until they become too large relative to the incomes, and then they come tumbling down in big debt and economic crises.”

So why don’t central bankers don’t do a better job of preventing debt crises from happening? There are four reasons for this.

First, most everyone, including central bankers, wants the markets and the economy to go up, because that’s rewarding. And they don’t worry too much about the pain of paying back, so they push the limits until debts become too burdensome and they have to be restructured to be reduced relative to incomes.

Second, it’s not exactly clear what risky debt levels are because it’s not clear what will happen that will determine future incomes. Third, there are opportunity costs to not providing the credit that creates debt. Fourth, and most importantly, debt crises, even big ones, can usually be managed to reduce the pain to an acceptable level. This is especially true if debts are denominated in a country’s own currency, because that allows central banks to print the money to alleviate the debt crisis. But of course, it always reduces the value of money.

4. Central banks can usually manage debt crises to reduce the pain they cause to acceptable levels by spreading out the payments.

When the debt is owned in their own currencies, central banks and policymakers can spread out those painful processes of restructuring the debt so that it’s not very painful at any one time. Debt burdens can be reduced in two ways. One way is reducing the amount of debt that has to be paid back, or spreading out the payments. That way is deflationary and depressing because one man’s debts are another man’s assets, so getting rid of the debt makes the creditor poorer, which leads to less spending.

“One way is reducing the amount of debt that has to be paid back, or spreading out the payments.”

Debt burden can also be reduced by central banks creating money and credit and getting it to the major debtors to help them pay their debts. That way is inflationary and stimulative. When central banks do both together, they can get rid of the debt with deflationary and inflationary pressures balancing each other.

5. Debt isn’t always bad, because it creates as many opportunities as challenges.

Too little credit or debt growth can create as bad or worse economic problems as too much, with the costs coming in the form of foregone opportunities.

Generally speaking, because credit creates both spending power and debt, whether or not more credit is desirable depends on whether the borrowed money is used productively enough to generate sufficient income to service the debt. If that occurs, the resources will have been well allocated, and both the lender and the borrower will benefit economically. If that doesn’t occur, the borrowers and the lenders won’t be satisfied, and there’s a good chance that the resources were poorly allocated.

In assessing this for society as a whole, one should consider the secondary indirect economics as well as the primary direct ones. For example, sometimes not enough money and credit is provided for such obviously cost-effective things as educating our children well, which would make them more productive while reducing crime and the cost of incarceration, or replacing inefficient infrastructure, because a fiscal conservatism that insists that borrowing to do such things is bad for the society, and that’s not true.

So you can have non-cost-effective uses that improve the society, which means everything can’t be measured exactly that way. Also, debt crises create exchanges of wealth that reward those who know how to manage their finances well at the expense of those who don’t. And they don’t last very long, typically less than or up to three years.

To listen to the audio version read by author Ray Dalio, download the Next Big Idea App today: