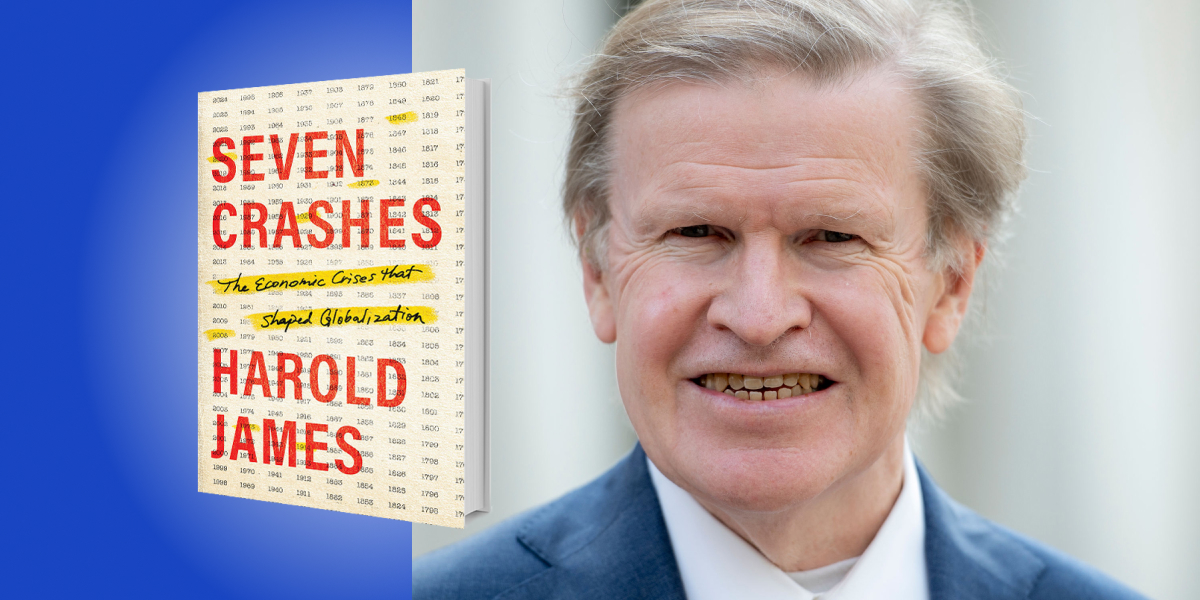

Harold James is an award-winning economic historian who teaches at Princeton University and Princeton’s School of Public and International Affairs. He is also the official historian of the International Monetary Fund. Below, he shares five key insights from his new book, Seven Crashes: The Economic Crises that Shaped Globalization. Listen to the audio version—read by Harold himself—in the Next Big Idea App.

1. Our current global predicament is not unique.

Many people think about the world as being deglobalized. It’s falling apart. It’s moving into competition between the great powers, into competing blocks. It looks like a repetition of the 1930s. Acute food shortages produce famine. Infectious diseases spread among an undernourished population. Social unrest flares up. Political systems are challenged and destroyed.

Currently, certain geographic hotspots dominate the geopolitical imagination: the Eastern Mediterranean, the Black Sea, the Dardanelles. That passage between the Black Sea and the Mediterranean assumes a global significance. It’s a thin needle connecting the grain-producing areas of autocratically controlled central Eurasia to hungry or starving consumers. That is the present moment, but it also describes moments in the past. This scenario has played out regularly over the centuries: at the end of the 1840s, during the First World War, and of course after the Russian attack on Ukraine in 2022.

In the 1970s, the Middle East was the focus of intense global debate about energy security. The fear was that resources are controlled by hostile or malign or simply completely alien powers. There are many challenges to coordinating effective domestic and foreign policies, and threats to resources are fundamental drivers.

2. Globalization isn’t a smooth process.

Globalization doesn’t go continually upwards. It’s often interrupted. At moments, we think globalization benefits everybody, that the possibility of migrating offers people a chance to escape misery and poverty. That getting goods from long distances offers cheaper products and improved lifestyles. That in order to develop, countries need to import capital.

At other moments, the discussion shifts into reverse. Migration is a challenge because migrants will take the jobs of native workers. Or a migrant worker presence will lower wages for everyone. There’s political pressure to crack down on immigration because of such fears. There’s a parallel feeling that imported goods threaten jobs and also push down wages. The resulting pressure on governments is to establish tariffs.

“We seem to be in a period of putting globalization in reverse.”

Due to alternating visions about the benefits and threats of globalization, we have moments of pushing globalization forward and moments of pulling globalization back. Currently, we seem to be in a period of putting globalization in reverse. Many famous, prominent people will tell you the world is deglobalizing, such as Larry Fink of BlackRock. The world is deglobalizing after the Russia-Ukraine War.

3. Shortages contribute to the development of the world.

Shortages are drivers of institutional and technical innovation. They often lead to old technologies being reintroduced in a transformative way. I have three examples of that process.

First is the turning point of the middle of the 19th century. The 1840s in Europe were a time of hunger, shortage, and misery. The harvest failed. The summers were rainy, with hardly any sun. Crops molded and potato fields were hit by a fungal infection. People who depended on the potato for nutrients suddenly had nothing. That pushed a crisis of government and institutions because there was a radical rethinking in general discourse of what government can and should do, and how technology should be taken up.

The technology taken up at that moment was the steam engine. There were already steam engines in the early 18th century. Matthew Bolton and James Watt developed their effective working steam engine in the 1770s. But for some time, the steam engine was only used for stationary actions, mostly for taking water out of mines. Steam engine technology was applied to locomotion in the 1820s and 1830s—but still only very partially. There were short railway lines connecting individual places, but no big networks.

The reaction to the shortages was to see that the steam engine, in the form of the locomotive for railroads or as steam ships across the oceans, could connect the world. The middle of the 19th century suddenly celebrated the steam engine as an instrument of integration. It would solve the problem of shortages, at least for the moment. In the 1850s and 1860s, the world developed quite quickly.

“Connectivity driven by technology transformed the world.”

The second instance is the 1970s, in the aftermath of the oil crisis. There were big increases in the world oil price and shortages at the pumps, people being banned from using their cars on certain days of the week, and a major sense of the disintegration of institutions. At that moment, the container ship took the spotlight. The first container ship was developed in the 1930s, but it’s in the 1970s that the container ship came into its own by radically reducing the cost of ocean transportation. Again, connectivity driven by technology transformed the world.

Finally, in 2020 there was the outbreak of the pandemic, and a relatively old technology, developed in principle in the 1990s for mRNA vaccines, suddenly had a critical opportunity for large-scale application. Up until then, this technology had only been used to treat pretty rare tropical diseases. Quickly, vaccination with mRNA vaccines became widespread and enabled an effective response to the COVID pandemic.

The transformative power of technology drives globalization as well.

4. Different crises that interrupt globalization call for different economic responses.

The crises that interrupt globalization can be categorized as supply shocks (like the 1840s or 1970s) or demand shocks (like the Great Depression or the 2008 financial crisis).

These produce very different responses. Demand shocks produce the sense that greater government activism is required. The master of that is John Maynard Keynes, the British economist, who in 1936, in the aftermath of the Great Depression, wrote The General Theory of Employment, Interest and Money. His book transformed the way in which economists, governments, and voters thought about economic processes. After 2008, exactly that kind of thinking returned.

“We learn most when the present is most dismal.”

Another kind of thinking develops in response to shortages and supply shocks. This thinking pays attention to the movement of relative prices rather than aggregate prices and looks at incentives. So, microeconomics is a response to supply shocks because the focus is on specific sensitivities. Macroeconomics, the big vision that governments can do fiscal stimulus, is a response to demand shocks.

For instance, during the pandemic, it was not a question just of getting fiscal stimulus for everybody, but demand for certain goods: medical supplies, protective equipment, vaccines. Those scarce goods aren’t created by putting money out indiscriminately. In the same way, after the Russian attack, there’s a heightened need for military goods, but those don’t just appear through greater spending.

5. Crises can be transformative in a positive sense.

In the middle of a crisis, we look at the bleak side of what’s going on. We don’t see the opportunities, but we should if we want to be more hopeful.

Look at the lessons of the past. In the gloomy atmosphere of 1919, after the First World War, Keynes, the great Cambridge economist, wrote that things will have to get worse before they can get better. There’s an opportunity, a glimmer of hope there.

We learn most when the present is most dismal. We’re exactly at such a moment.

To listen to the audio version read by author Harold James, download the Next Big Idea App today: