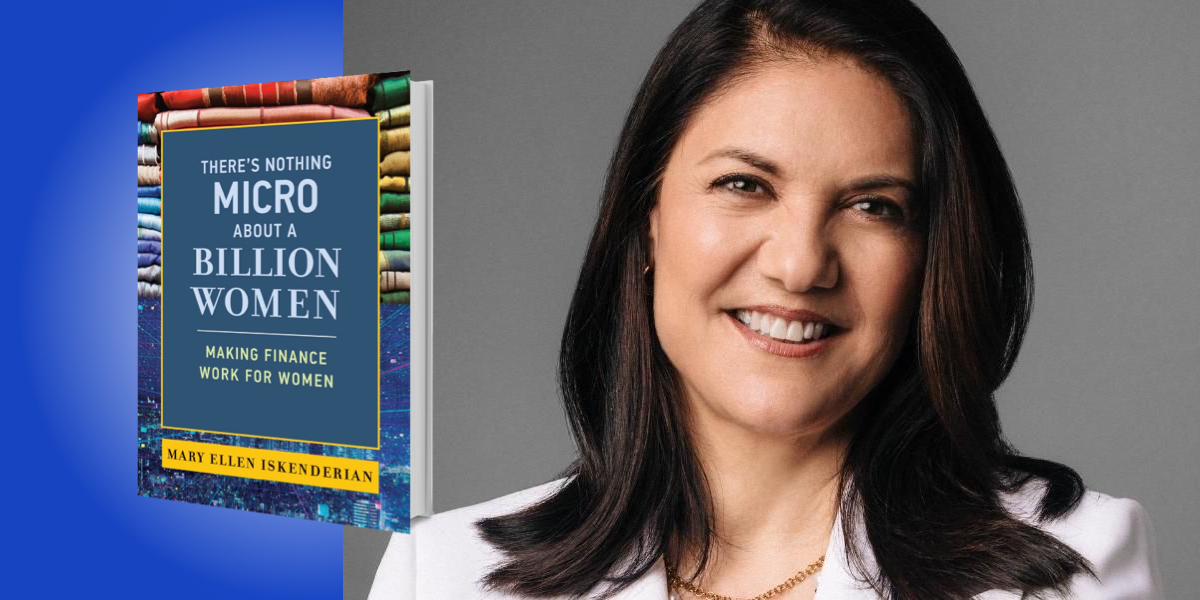

Mary Ellen Iskenderian is the President and CEO of Women’s World Banking, a nonprofit dedicated to economic empowerment for women around the globe, holding this position for over 15 years. Her prior experience includes nearly two decades working for the International Finance Corporation.

Below, Mary Ellen shares 5 key insights from her new book, There’s Nothing Micro About a Billion Women: Making Finance Work for Women. Listen to the audio version—read by Mary Ellen herself—in the Next Big Idea App.

1. To be fully included in the financial system requires more than a bank account.

The technical regulatory definition of being financially included is to own a bank account or mobile money account in one’s own name. There are 1.7 billion adults—one-third of the global adult population—who lack one of these accounts. More than half of those (57 percent) are women.

This definition doesn’t go far enough. To be truly included as a full participant in the financial system, everyone needs a broader range of financial products and services. The following are necessary:

- Convenient and affordable ways to make payments and send money.

- A safe place to save money.

- The ability to borrow for large purchases or take advantage of opportunities either personally or for a business.

- Insurance products to manage risks and protect all you’ve built.

But it’s not just about gaining access to these things. It’s also about having the knowledge and confidence to use these products with the appropriate technology, which increasingly means an internet-enabled smartphone.

Finally, to be included means to be treated with dignity as a client of financial service providers. Predatory tactics, such as being charged hidden fees or excessive interest rates, is exclusionary.

“To be included means to be treated with dignity as a client of financial service providers.”

2. Women’s financial inclusion drives macroeconomic growth.

Excluding people from the financial system is a drag on the system—it holds everyone back. Financial inclusion, on the other hand, is a driver not just of growth, but inclusive growth.

There’s ample research indicating that gender inequality correlates directly with the level of overall inequality in an economy. In addition, the benefits of inclusive growth can only be realized when those who are most excluded are brought into the economy. Women in every region, age group, and demographic category are the most excluded.

We simply cannot talk about financial inclusion, inclusive growth, or addressing economic inequality without looking at the ways in which women are systematically denied access to the levers of economic progress—most notably the financial tools.

Making all of those tools of economic opportunity available at parity to men and women alike would add $27 trillion to global GDP annually.

3. Financial service providers leave a lot of money on the table by not serving women.

The consulting firm Oliver Wyman identified a $700 billion annual revenue opportunity for banks, insurance companies, and asset management firms if they start providing financial services to women at the same rate that they are provided to men. That’s an amount equal to 5 to 20 percent of total revenue for each of those sectors in the financial services industry.

For instance, there are opportunities like $17 trillion in unmet financing needs for women-owned micro, small, and medium-sized enterprises, as well as $50 billion in life insurance premiums that could be written if women’s lives were insured at the same rate as men’s lives.

“Women typically have better loan repayment rates and are less likely to bounce checks.”

Women are proven to be good, loyal clients for financial service providers. In developed markets, 61 percent of female customers stay more than five years with a bank, compared to 46 percent of male customers. Women typically have better loan repayment rates and are less likely to bounce checks. Women also tend to be longer-term savers and build higher savings-to-income ratios than men.

Designing financial products that take women’s needs into account can unlock myriad profits for financial service providers. They just have to be willing to break out of the rut of offering products designed for men, by men. Features such as confidentiality and convenience may be nice for men, but they are essential to gaining women’s trust and their business.

4. Women’s financial inclusion has transformative impacts on lives.

The term “women’s economic empowerment” suffers from over-use and being under-defined. Economist Naila Kabeer eloquently captures the essence of empowerment as the ability to make “strategic life choices…the choice of livelihood, where to live, who to marry, whether to marry, whether to have children, how many children to have, who has rights over children, freedom of movement and choice of friends that are critical for people to live the lives they want.”

Women are changed and empowered across four main pathways when they gain access to financial tools. In addition to material changes, such as increased household income or assets, we can measure cognitive changes through the improved knowledge, skills, and awareness that come with financial and digital literacy.

Women also experience relational changes within their families and communities. When a woman has more control over financial resources, she also gains a greater say in household decision-making. Her decisions—in stark contrast to men’s decisions—benefit more members of the family through spending on education, health care, housing, and nutrition.

“When a woman has more control over financial resources, she also gains a greater say in household decision-making.”

In some cases, once women have been financially included, they are more likely to vote or run for public office. They gain greater confidence and motivation to plan and hope for the future.

5. Everyone can advance women’s financial inclusion.

A well-known Harvard Business Review article on the “female economy” notes that financial services win the prize as the industry least sympathetic to women, yet with the most to gain from including women.

All of us can be conscientious consumers of financial services and hold providers accountable. Start by insisting on gender diversity—do you know how many women are in the senior leadership of your bank or insurance company? Gender diversity is important because it leads to larger, more consistent profits, increased innovation, and greater outreach to women clients.

Next, you can teach digital and financial literacy early. Some research indicates that age five is the optimal time to start children on the path to financial confidence.

You could consider a gender lens investment strategy for your own portfolio. This is an investment approach that recognizes the value of investing in women-led companies or companies that offer products and services to women. To date, $8 billion has been invested in ETFs and mutual funds and various private instruments according to a gender lens strategy.

To listen to the audio version read by author Mary Ellen Eskenderian, download the Next Big Idea App today: