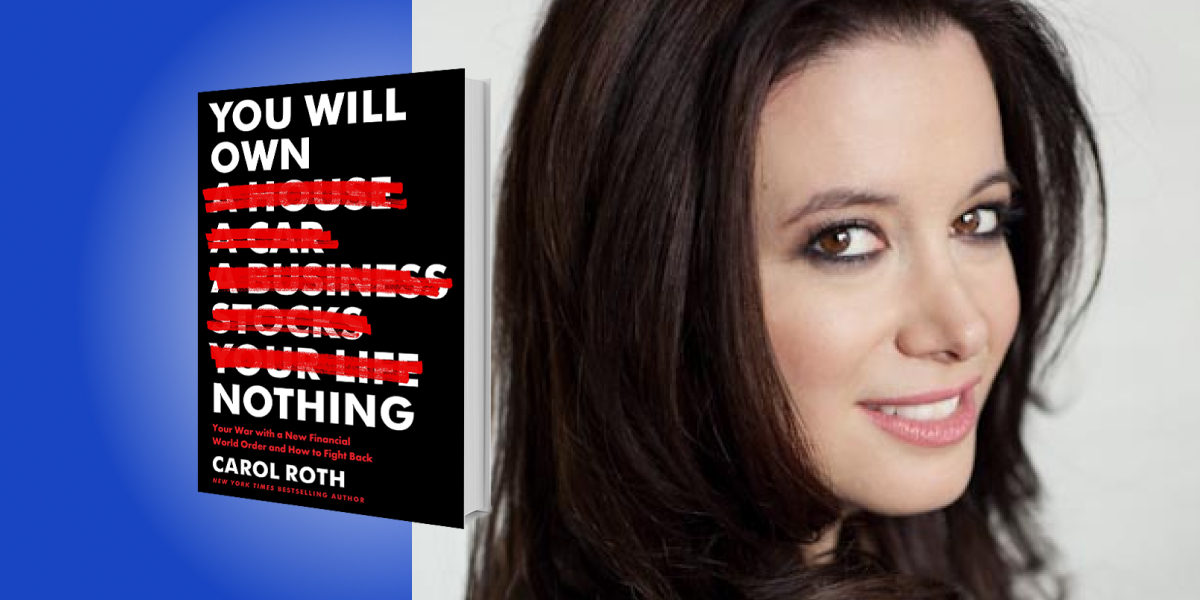

Carol Roth is a “recovering” investment banker, entrepreneur, and New York Times bestselling author. She also has more than a decade of media experience, having been a judge on America’s Greatest Makers, a panelist for Closing Bell on CNBC, and a radio host for WGN, among others.

Below, Carol shares 5 key insights from her new book, You Will Own Nothing: Your War with a New Financial World Order and How to Fight Back. Listen to the audio version—read by Carol herself—in the Next Big Idea App.

1. You may own nothing, but you won’t be happy.

When I first heard the prediction that you’ll own nothing and you’ll be happy in a video from the World Economic Forum, a group littered with the political and business elite, I thought it must have been out of context. How could a group affiliated with such savvy and well-connected people be predicting the end of private property—by 2030, nonetheless?

But I found the video and yes, there it was, in the open, and consistent with several other pieces they have put out over the years. So I became concerned. As someone who has advocated for and helped people with wealth-creation opportunities for more than a quarter century, I know one thing to be true: Wealth comes from ownership. That is indisputable.

More concretely, wealth comes from the ownership of assets that increase in value over time. Asset ownership provides the ability for people to increase their wealth exponentially, meaning by several multiples of the original investment. This is something that working and earning alone cannot do.

The idea that you will own nothing translates to me as a massive barrier to individual wealth creation. Not to mention that the people throughout history who haven’t owned property have found themselves unfree, unhappy, and worse.

Also note the language of the prediction. It’s you’ll own nothing, not we’ll own nothing. Clearly, the group putting out the prediction imagines a different set of outcomes for themselves. The you’ll be happy part tries to suggest that fewer wealth creation opportunities will make for a free and relaxing lifestyle. Those seeking to retain wealth and power as the global financial stakes shift would definitely prefer you buy into that notion, rather than force it upon you.

2. A new world order is not a conspiracy theory.

What could sound more like a conspiracy than a new financial world order? But it’s not historically unheard of. The U.S. has been at the center of the global financial universe for about 80 years now, holding the world’s reserve currency. But before the U.S. held that position, it was the British, and it was the Dutch before them.

People who study history know the financial order changes on a regular basis. Even the current President of the United States has said as much. In a speech to the Business Roundtable on March 21, 2022, President Biden said:

“You know, we are at an inflection point, I believe, in the world economy— not just the world economy, in the world. It occurs every three or four generations…And now is a time when things are shifting. There’s going to be a new world order out there, and we’ve got to lead it.”

The President mentioned the cycles my book explores, he mentioned the economy’s role in this change, and he acknowledged that things are shifting.

“People who study history know the financial order changes on a regular basis.”

With a giant debt load foreboding an unsustainable financial trajectory for the United States, the Fed and government being derelict in their duty to maintain the stability of the world’s reserve currency, and the weaponization of the U.S. dollar (most recently when Russia’s access to its reserves was frozen after Russia invaded Ukraine), there are a lot of signposts that we are on the precipice of a new financial world order.

In fact, the number two prediction from the World Economic Forum’s video behind you’ll own nothing was that the U.S. will no longer be the world’s leading superpower. This shifting of financial stakes creates the foundational thesis of the book.

3. Wall Street is trying to rent you the American Dream.

Wall Street Corporations are competing with individuals for single-family homes and trying to rent the American Dream back to them.

A home is the illustrative symbol of the American Dream, for good reason. Across households, the home is the largest asset by dollar value on households’ balance sheets. Owning a home is a way that Americans build wealth for themselves and their families.

During the Great Recession, while both individuals and financial institutions took on too much risk vis-à-vis housing, their outcomes were starkly different. Individuals lost almost six million homes to foreclosures and short sales, while financial institutions received bailouts.

Then, the cheap capital from the Fed’s “easy money” policies enabled corporations to do something that they had never done before in history: compete with you for a home. This is a market that did not exist prior to 2010. As of last year, around one in every five homes sold in the U.S. was sold to a corporate investor.

These investors aren’t looking to flip the homes; they want to rent the American dream, enriching themselves at the expense of young people and other would-be homebuyers. This takes away the biggest wealth-creation mechanisms for families, transferring that wealth from Main Street to Wall Street.

“As of last year, around one in every five homes sold in the U.S. was sold to a corporate investor.”

NGOs like the World Economic Forum and publicly traded corporations buying up tens of thousands of single-family homes pretend that moving away from ownership is for your convenience and happiness. But the “care-free life” of not generating legacy wealth hasn’t worked out well for people throughout history.

Non-ownership of single-family homes also has concerning implications for freedom. Non-ownership means that more American lives are dictated by the cooperation and coercion of corporate and government forces.

Meanwhile, the wealthiest are buying up more hard assets. We know the rich and well-connected will continue to own housing assets and collect the wealth driven by both the rents and the price appreciation of those houses. That’s why the prediction is “you’ll own nothing”—not “we’ll own nothing.”

4. A wealth tax will kill the middle class and younger generations.

Speaking of the middle and working class, one bright spot for younger generations is that there is nearly $85 trillion in assets set to be voluntarily passed down over the next couple of decades via inheritances. However, that is a lot of money potentially at risk.

The U.S. has recently seen its second credit downgrade. The public debt has surpassed the GDP. There was, at the end of 2021, more than $129 trillion in unfunded liabilities—think government promises. Even the Treasury and the Congressional Budget Office have said we are on an unsustainable financial trajectory. This means that the $85 trillion in wealth to be transferred, as well as the rest of individuals’ wealth, looks really appealing to the government.

We have heard recent calls for wealth taxes. The mantra “we are going after billionaires and the ultra-wealthy” is a trick they use to get you to give up your principles because once you do, they can come after you.

“Beware of calls for wealth taxes and rules aimed at just one group of people.”

Just like they aren’t trying to hire 80,000 IRS agents to go after 800 or so billionaires, they aren’t looking to add wealth taxes and expand estate taxes to come after the ultra-wealthy. The wealthy are the friends and financial supporters of those making the laws. They can afford fancy lawyers and accountants to find loopholes. The middle class, which holds a substantial portion of wealth, doesn’t have those advocates and service providers.

Here’s what is at stake if they put in place wealth taxes or taxes on “unrealized capital gains.” Imagine that your parents bought a house in the 1970s for $100,000. Today, you look on Zillow and it estimates that it is worth $2 million. That means they would owe taxes on $1.9 million. How could they pay for that? They would have to sell the house to do so. Imagine that for businesses, stocks, farms, art, and more. This would be a devastating outcome that would upend American prosperity as we know it.

Beware of calls for wealth taxes and rules aimed at just one group of people because, eventually, that can be used to come after your money and your legacy wealth.

5. You can fight back.

Our current financial and economic moment can seem overwhelming and depressing. But you can take it in stride and fight back as an individual. Here are a few practical takeaways:

- Do what they do, not what they say. The elite are buying up real estate. They are buying up productive land. Central banks and wealthy individuals are loading up on gold and precious metals. They are making sure to own assets that retain their value or increase in value. Follow their actions.

- Diversify your assets and financial portfolio. There is a range of possible catalysts and outcomes to shifts in the global financial order. Plus, we don’t know the timeline. That means you need to have a diversified, hedged, and resilient portfolio to be prepared for worst-case scenarios.

- Do your preparation plan. Take the time to make a plan in case the worst outcomes come to pass. You don’t anticipate there will be a fire, but in case there is one, have an escape plan and insurance policy in place before the fire.

Have you visited an estate planning attorney to discuss trusts for your assets, or gifting to loved ones while alive? If a Central Bank Digital Currency were to be implemented, how would you barter and trade if your access to funds were frozen for some period of time? Do you have small denomination precious metals, or something else? Think through these things today so that you can seamlessly address any periods of financial or geopolitical chaos.

To listen to the audio version read by author Carol Roth, download the Next Big Idea App today: